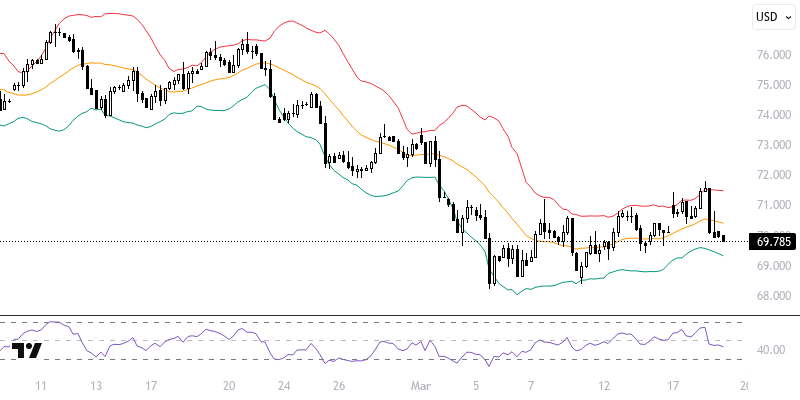

BRNUSD

Oil futures declined following the agreement between Trump and Putin to halt energy and infrastructure attacks in Ukraine. However, Russia rejected the 30-day ceasefire. This development is being monitored as a pressure point, despite Russia's increased engagement in the global market. The American Petroleum Institute's announcement of a 4.6 million barrel increase in stocks was another factor putting pressure on the market. Stock data to be released by the U.S. Energy Information Administration and the Federal Reserve's monetary policy statements will be monitored throughout the day.

If prices remain below the resistance levels of 70.50 – 71.00, a downward trend may emerge. Potential declines could target the levels of 70.00 and 69.50. In the event of recoveries, if the resistance at 70.50 – 71.00 holds, new decline potential may arise. Continuation of the upward trend requires closing above 71.00; in this case, the level of 71.50 may come into play. Key Level: 70.50 – 71.00.

Support :

Resistance :