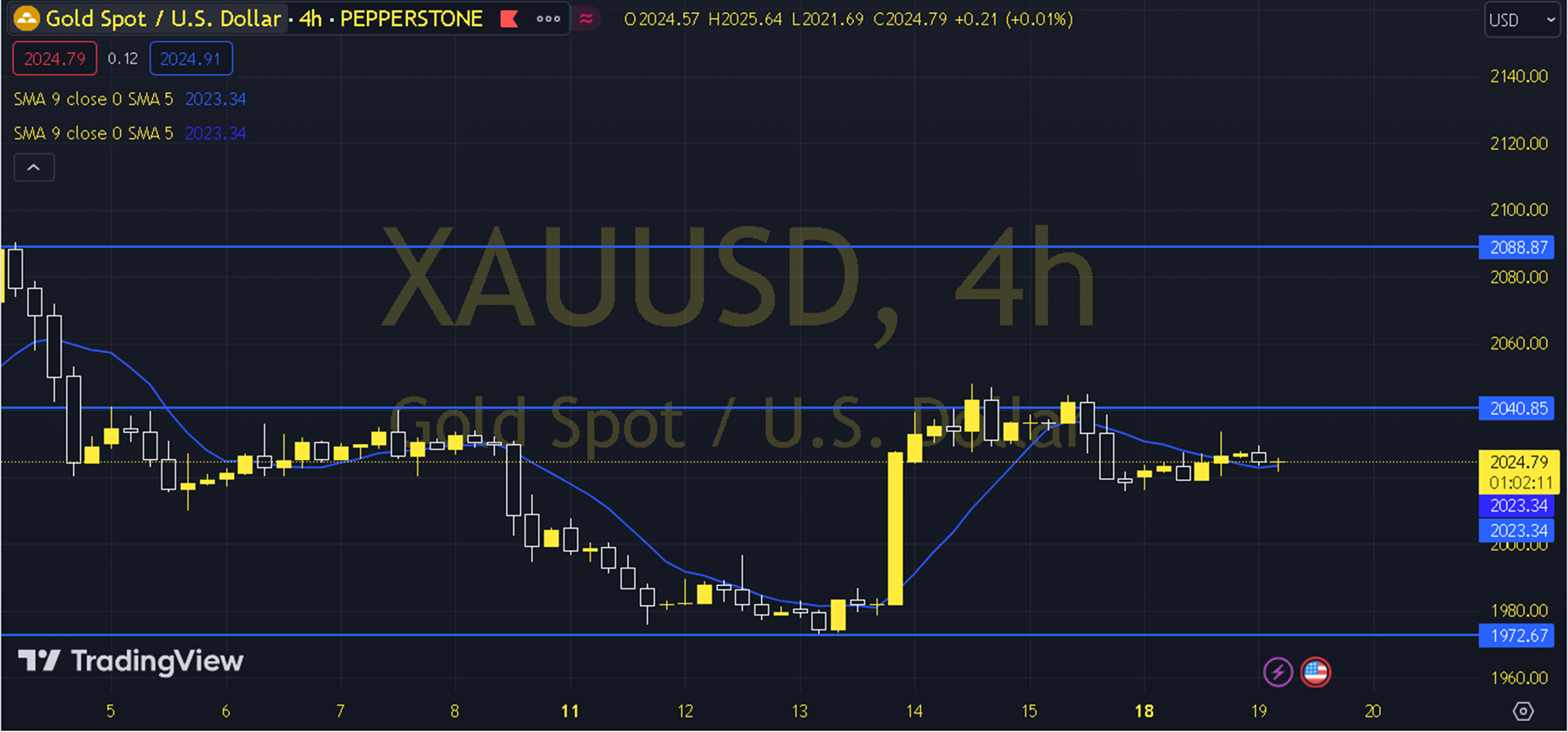

XAUUSD

ONS Gold US 10-year Treasury yield moving towards 3.95% recorded an outlook that suppressed their recovery. Construction permits and FOMC member Barkin's speech can be followed during the day due to their possible effects. When we evaluate short-term ounce gold pricing technically, we are following the 2012 - 2030 region, which is currently supported by the 34-period exponential moving average (2019). As the precious metal forms within the 2012 - 2030 region, permanent pricing above the 2030 level may be needed for the positive expectation to be reinforced. In possible recoveries, the 2040 and 2052 levels may come to the agenda. In order for the negative expectation to come to the fore, it may be necessary to remain below the 2012 level. In possible declines, the 2003 and 1993 levels may be encountered. Support: 2021-2013 Resistance: 2038-2050