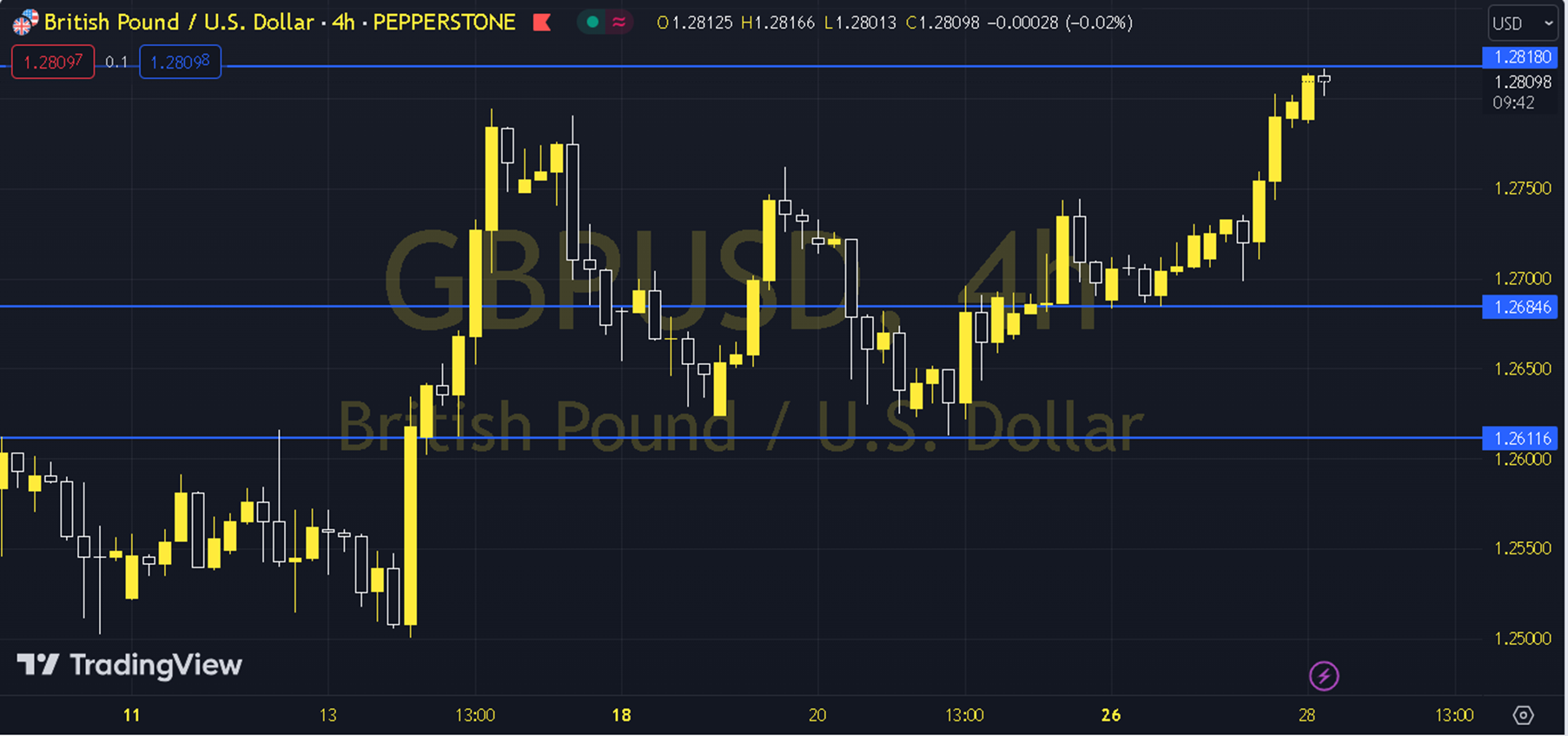

GBPUSD

Although the short-term positive trend view is at the forefront for the GBPUSD parity, it has not yet been able to escape from the long-term negative zone limits. The questions of whether there will be a change in the long-term outlook for the parities in the upcoming period in the Fed, ECB and BoE interest rate cut race should be followed carefully. When we evaluate the GBPUSD parity in the short term, the 34-period 1.2730 region is important and may want to continue the upward trend. With this in mind, pricing can be monitored towards the barriers of 1.2825, 1.2875 and 1.2930. In the possible reaction thought, it should not be forgotten that the 34-period average is an intermediate support, and even if the declines continue, the 200-period average (1.2580) will continue to be the main support. Support: 1.27300 Resistance: 1.28750