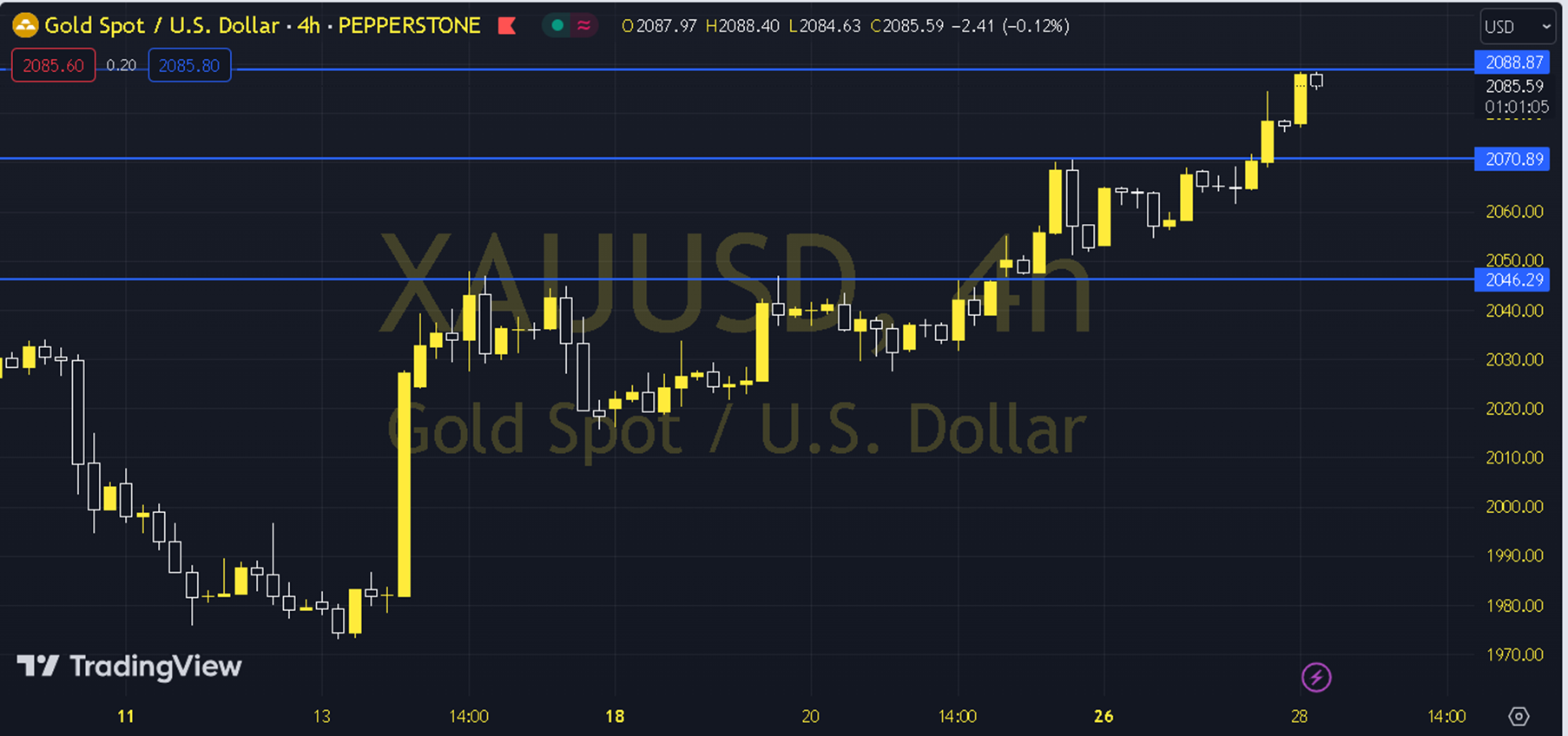

XAUUSD

Gold Ons With the support of the US 10-year Treasury bond yield falling below 3.80%, gold onslaught has been dominant in the short term. When we technically evaluate short-term gold onslaught prices, we are following the 2061-2070 region, which is currently supported by the 13 (2071) and 34 (2056) period exponential moving averages. As long as the precious metal is traded above the 2061-2070 region, the upward trend may continue. If the positive pricing desire continues, the 2090 and 2100 levels may be encountered. In the alternative view, it may be necessary to see permanence below the 2061-2070 region for the negative expectation to come to the fore. In this case, the 2052 and 2040 levels may come to the agenda. Support: 2070-2061 Resistance: 2090-2100