WTI

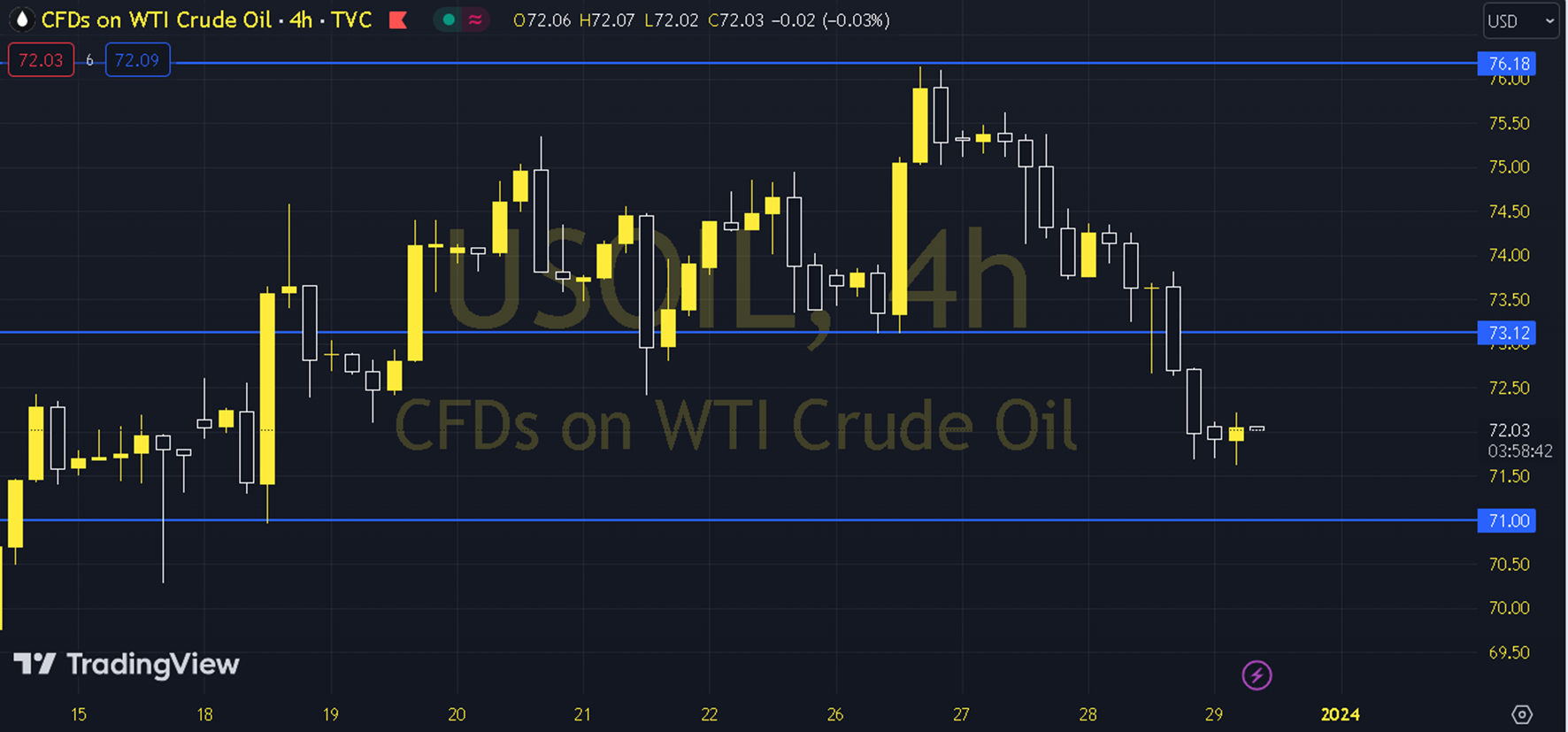

Despite the US Energy Information Administration announcing a decrease of over 7 million barrels in stocks, oil prices are approaching the end of the year with a decline. Although the fact that US forces are trying to provide security in the Red Sea is effective in this picture, the idea that supply will remain strong against demand in the coming year seems to be at the forefront. The course of European and US stock markets can be followed during the day. As long as pricing remains below the 72.50 - 73.00 resistance in the upcoming period, downward potential may continue. In possible declines, 71.50 and 71.00 levels can be targeted. In possible recoveries, as long as the 72.50 - 73.00 resistance remains current, new downward potential may occur. Therefore, it may be necessary to see the course above 73.00 and hourly closings for the continuation of the upward desire. In this case, 73.50 and 74.00 levels may come to the agenda. Support: 71.50 Resistance: 73.00