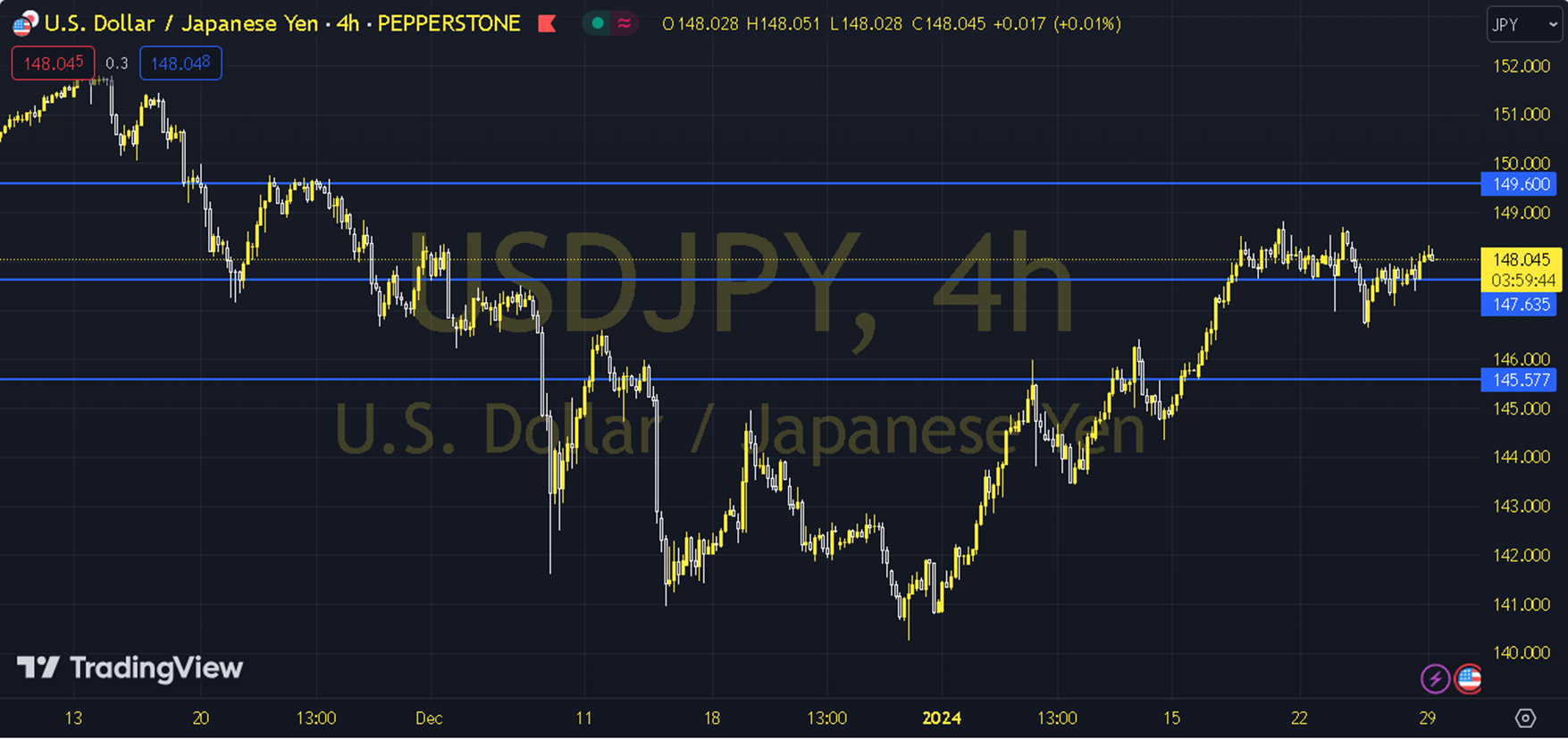

USDJPY

USDJPY Pair starts the week as markets in Japan try to predict when to exit the negative interest rate policy, while Tokyo core inflation reached its lowest level since March 2022 and became 1.6%. This is a development that may put pressure on the markets' expectations of exiting negative interest rates. While the 34-day average of 102.45 for the Classic Dollar Index and the 233-day average of 4.02 for the US 10-year bond interest rate are important, it should not be forgotten that negative pressure continues as long as the reference indicators are not exceeded. USDJPY Pair continues to price above the 55-day period. The parity, which started the day with an increase, is priced above its 200-day average. If the day closes above 149.100, the idea of a New Ath may come to the fore. If there is a decrease, it is expected to reach 147.135. Support: 147.135 Resistance: 149.100