XAUUSD

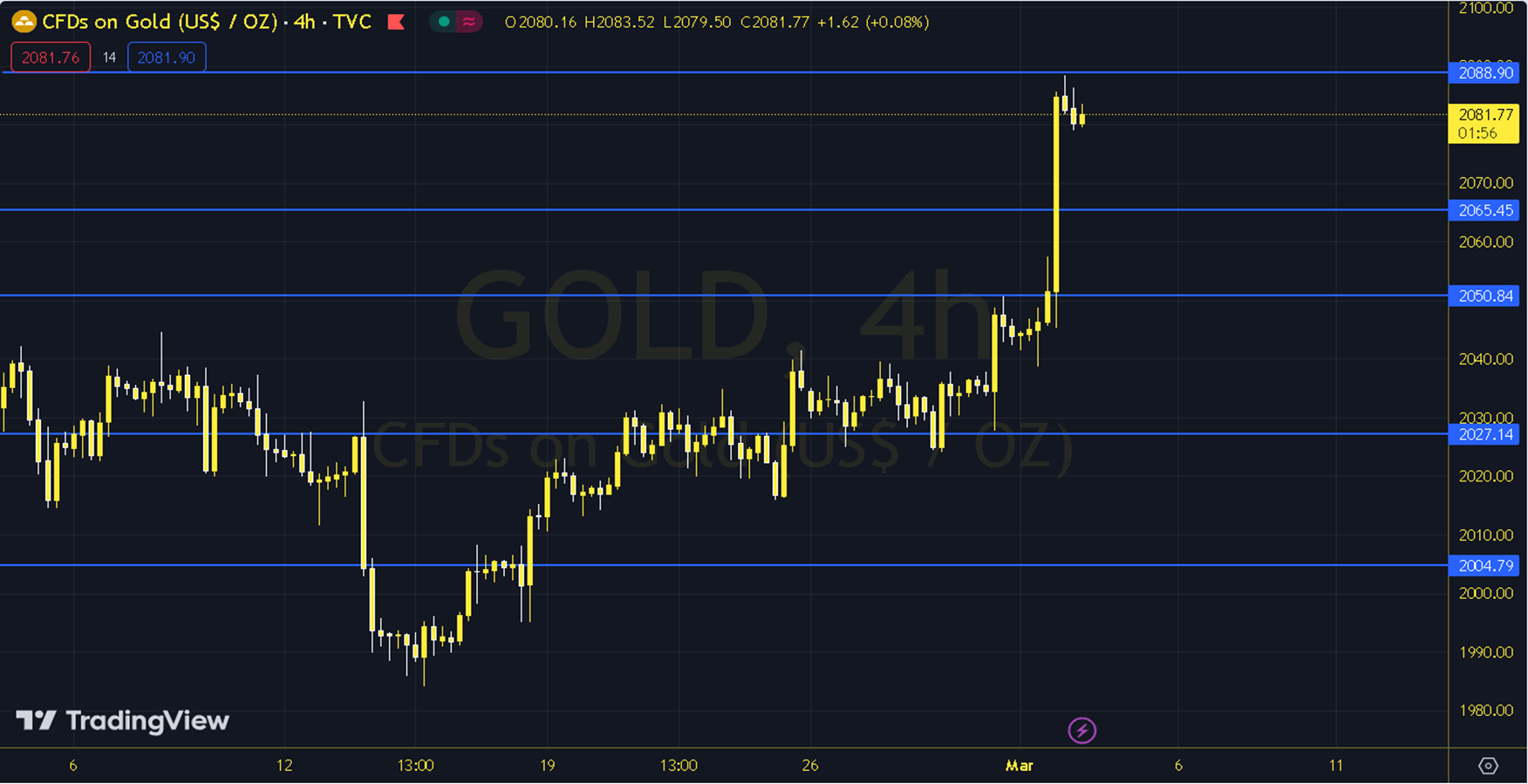

Following the data from the US on Friday, with the support of the US 10-year Treasury bond yield falling below 4.20%, ounce gold showed increases in the short term and then suppressed its upward movements. When we evaluate the short-term ounce gold pricing technically, we are following the 2052 - 2061 region, which is currently supported by the 13 (2061) and 34 (2045) period exponential moving averages. As long as the precious metal is traded above the 2052 - 2061 region, the upward trend may continue. If the positive pricing desire continues, the 2090 and 2100 levels may be encountered. At this stage, the attitude of the 2090 level can be monitored in terms of the continuation of the upward expectation. In the alternative view, it may be necessary to see permanence below the 2052 - 2061 region in order for the negative expectation to come to the fore. In this case, the 2040 and 2030 levels may come to the agenda. Support: 2061-2052 Resistance: 2090-2100