BRENT

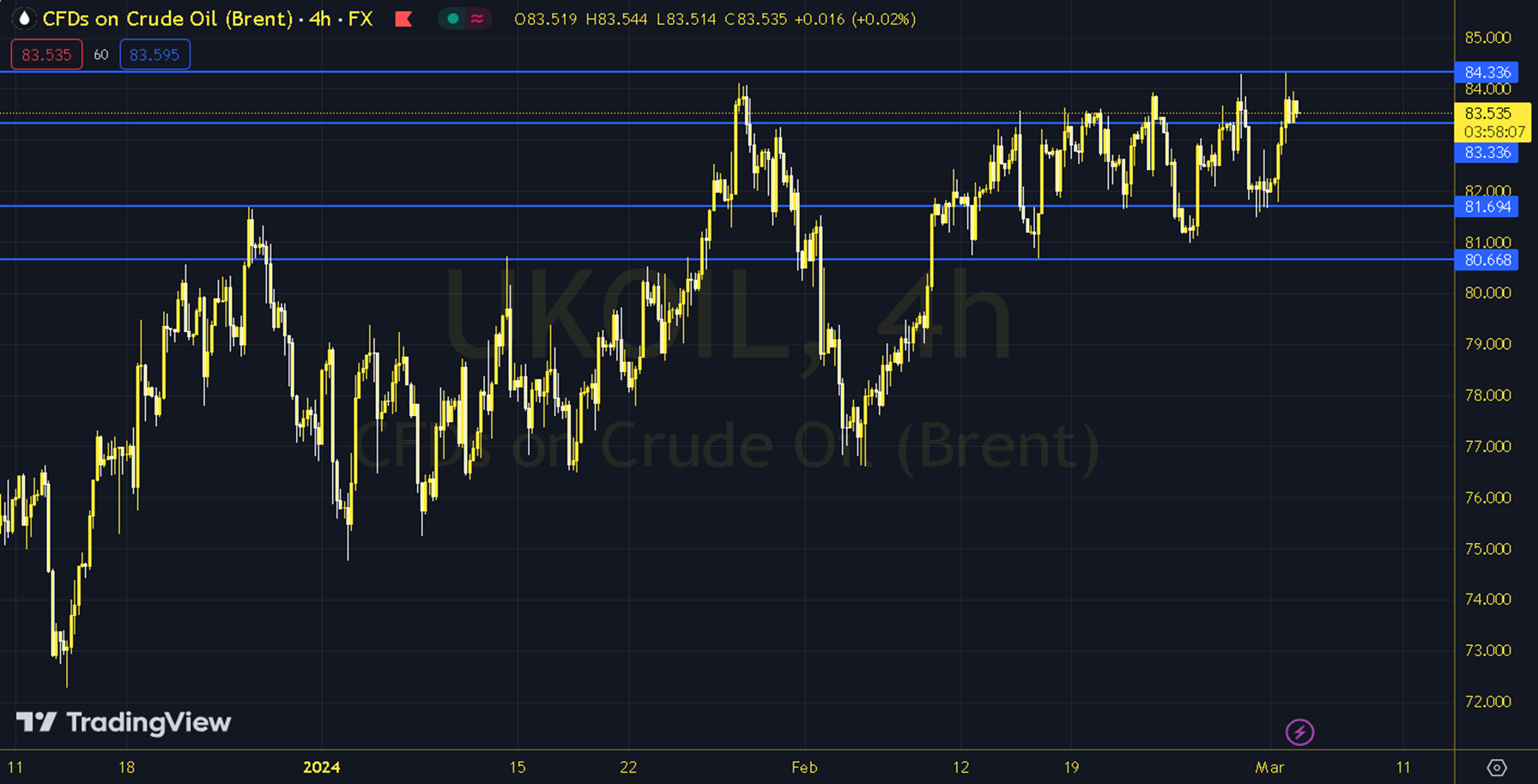

OPEC+'s decision to extend the production cut until the end of June was effective in the increase in oil prices. Brent oil futures contracts are moving close to their highest levels since November. At the same time, the disruptions regarding the ceasefire process for Gaza also supported this picture. The US-focused headlines seem to be intense again throughout the week. The course of European and US stock markets can be followed during the day. As long as the pricing remains at and above the 83.00 - 83.50 support in the upcoming process, an upward outlook may be at the forefront. In possible increases, the 84.00 and 84.50 levels can be targeted. In possible decreases, as long as the 83.00 - 83.50 support remains current, new upward potential may occur. Therefore, it may be necessary to see the course below 83.00 and hourly closings for the continuation of the downward desire. In this case, the 82.50 level may come to the agenda. Support: 83.00 Resistance: 84.50