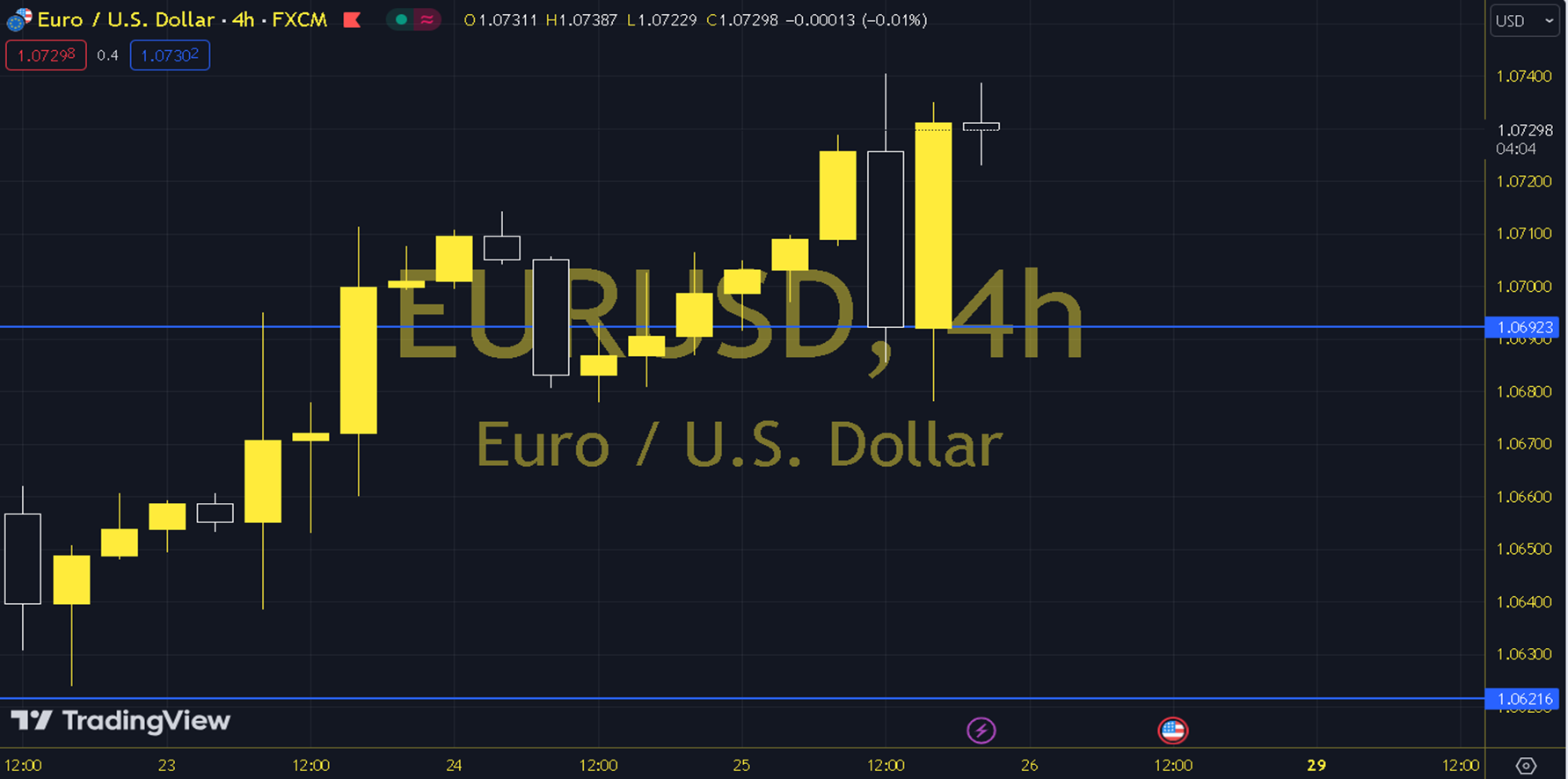

EURUSD

We are on the most important day of the week. Before the Fed meeting on May 1, the markets will reach the result of the PCE Inflation data, which is a leading indicator for inflation and which the Fed also includes in its projections. Following the latest employment and especially inflation data, the markets are pricing the Fed to cut interest rates in September, and the answer to the question of whether this idea will be supported by the PCE data or revised is important in terms of the Dollar Index and therefore the short-term course of EURUSD and GBPUSD. The 1.0725 level can be followed in intraday upward movements. If this level is exceeded, the resistances of 1.0731, 1.0739 and 1.0745 may become important. In possible pullbacks, 1.0717, 1.0711 and 1.0703 will be monitored as support levels. Support: 1.0717 – 1.0711 Resistance: 1.0731 – 1.0739