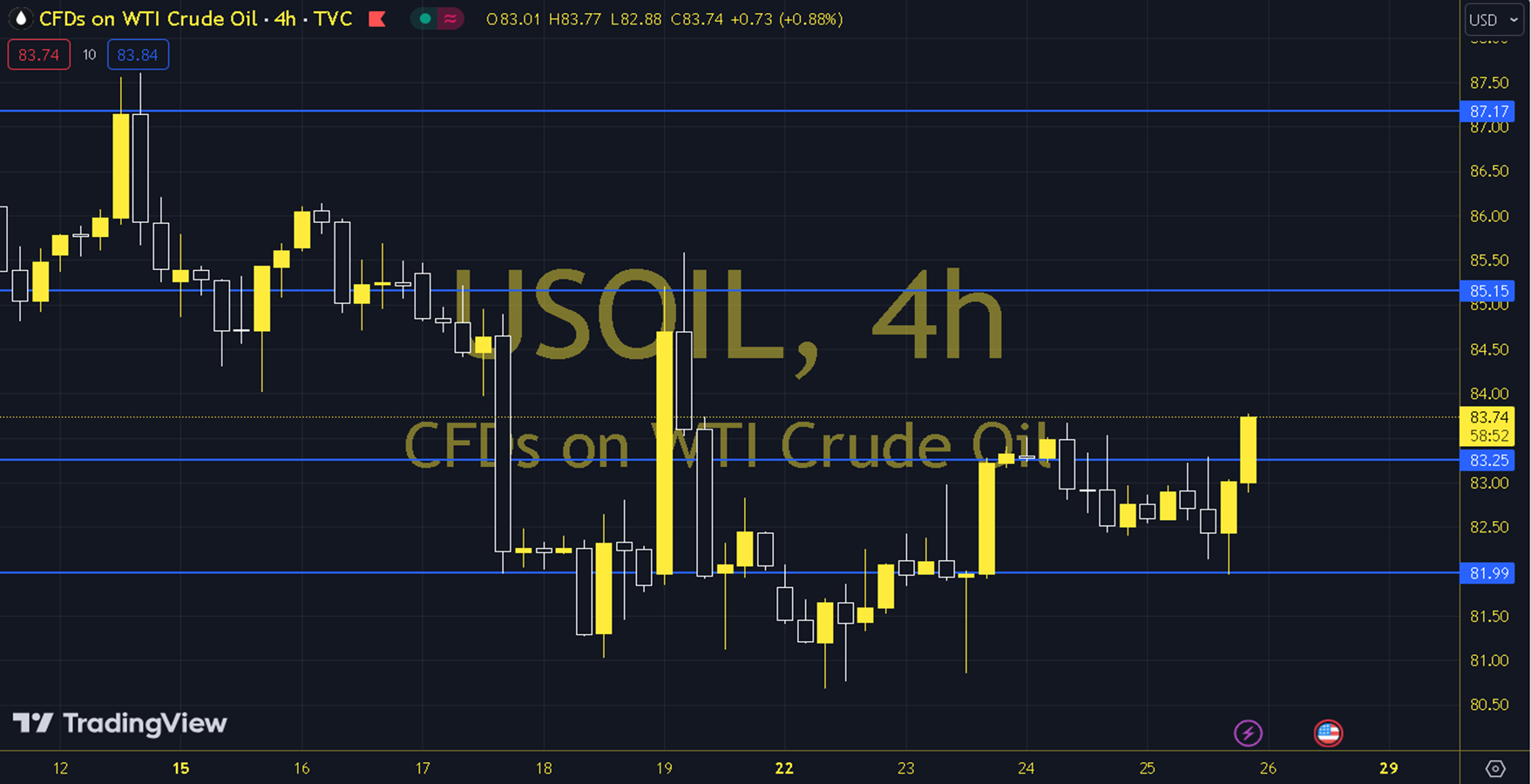

WTIUSD

After the first quarter growth announced below expectations in the US yesterday, although the initial effect was a decline in oil futures, we later saw that recovery came to the fore and that it was heading towards gains before the PCE inflation to be announced today. Therefore, the course of the US stock markets and the PCE inflation data can be followed during the day. All averages were broken with the rise. If the 83.00 - 83.50 support and above is maintained during the day, the upward trend may continue. In possible increases, 84.50 and 85.00 levels can be targeted after the 84.00 resistance. In possible pullbacks, as long as the 83.00 - 83.50 support remains current, new upward potential may occur. Therefore, it may be necessary to see the course below 83.00 and 4-hour closings for the continuation of the downward desire. In this case, 82.50 and 82.00 levels may come to the agenda. Support: 83.50 - 83.00 Resistance: 84.50 - 85.00