BRENT

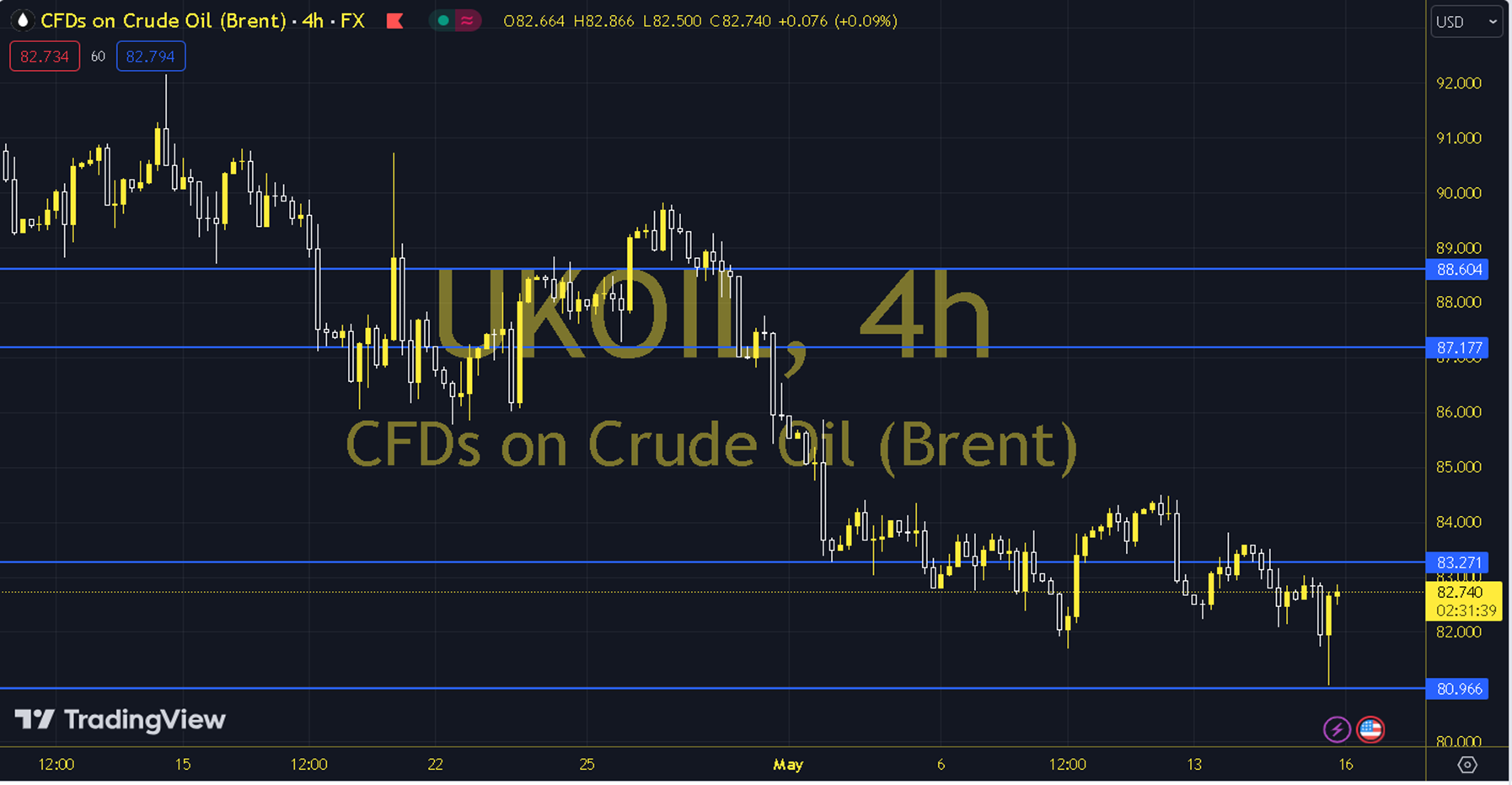

According to the US Energy Information Administration; crude oil inventories decreased more than expected. Energy Information Administration data showed that US crude oil inventories decreased by 2.5 million barrels, exceeding expectations for a decrease of 400 thousand barrels. On the other hand, the cooling signs of the US CPI data caused the Dollar Index to decline and both developments supported oil prices. It is seen that there is a general downtrend. Brent oil saw a high of 82.79 and a low of 80.85 on the previous trading day. Brent oil, which followed a buying trend on the last trading day, gained 0.23% daily. The RSI indicator for the commodity, which is below its 20-day moving average, is at 38.39, while its momentum is at 94.77. The 82.11 level can be followed in intraday downward movements. If this level is dropped, the supports of 81.42, 80.17 and 79.48 may become important. In possible increases, 83.36, 84.05 and 85.31 will be monitored as resistance levels. Support: 82.11 - 81.42 Resistance: 83.36 - 84.05