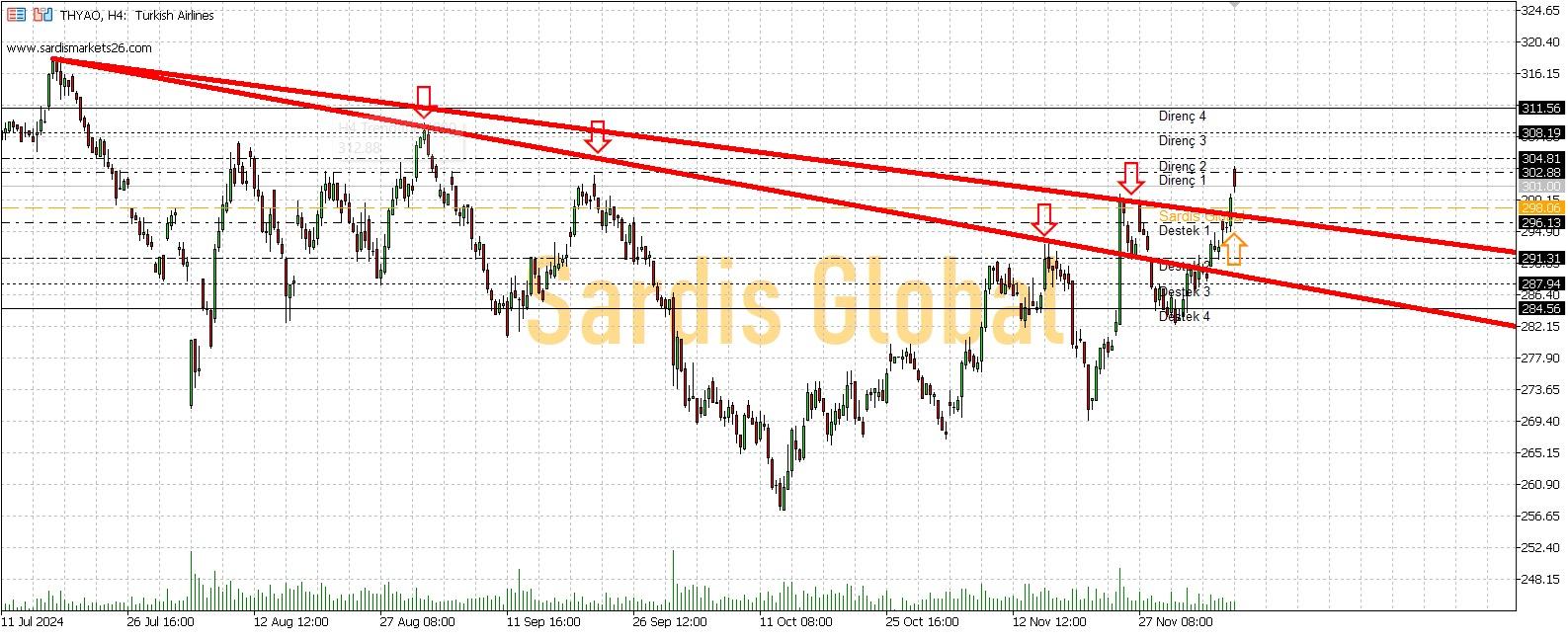

THYAO

THYAO - An analysis of Turkish Airlines' stock from a fundamental perspective indicates clear positive data. A sectoral evaluation reveals that the stock is favorably priced or undervalued. Recent increases in EBITDA, net sales, net profit, and fixed assets demonstrate the company's ongoing strength. With substantial foreign currency income, Turkish Airlines shows technical improvement once the 296.00 level is surpassed, turning the pricing trend positive. The stock is deemed suitable for buying, given its technical strength and clear positive fundamentals. The absence of rare negative data in the financial statements suggests that any pullbacks in the stock may present buying opportunities. Currently priced at 301.00 TL, resistance levels are identified at 311, 330, and 356. The financial outlook suggests these levels could be surpassed in the short term.