EURUSD

In the middle of the week, while PMI and private sector employment data related to the service sector draw attention, Trump's statements still maintain their popularity. The fact that Germany's Composite PMI data has risen above the 50 threshold reminds us that the ongoing issues in the manufacturing sector should not be overlooked. The better-than-expected private sector employment data in the U.S. signals that growth is slowing, despite the ISM Services PMI data remaining above the 50 threshold, even though it fell short of expectations. A similar situation is observed in the UK, where the growth rate has decreased, yet it continues to stay above the 50 threshold.

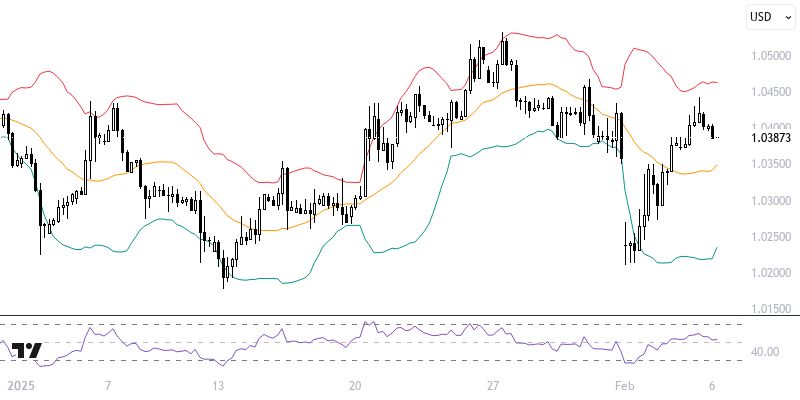

Despite approaching the 110 level, the Classic Dollar Index remains under pressure as it has not reacted sufficiently at this level. The index, which remains below the short-term indicator of the 34-day average (107.80), shows an optimistic stance above the main indicator, the 233-day exponential moving average (105); however, how the reactions will develop remains a question. The effects of this situation on the EURUSD and GBPUSD pairs should be closely monitored. With a recovery from the 1.0210 level, the EURUSD pair is moving within the 1.0375 – 1.0430 range, emphasizing a decision phase.

Support :

Resistance :