NDXUSD

The increase in non-farm payrolls exceeding expectations, combined with the decline in ISM services PMI data, led to a decrease in U.S. 10-year Treasury yields. This situation paved the way for rises in the NASDAQ 100 Index. The semiconductor sub-sector, particularly supporting the technology sector, and Nvidia's increase of over 5% reinforced this recovery. Throughout the day, unemployment claims and comments from FOMC member Waller will be closely monitored.

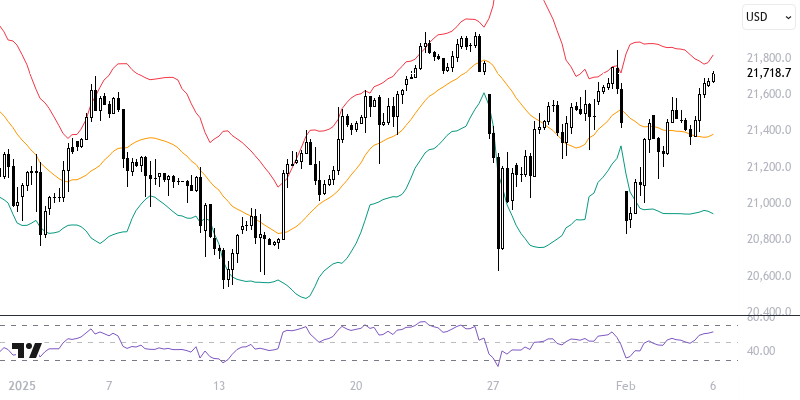

The NASDAQ 100 index is trading above the levels supported by the indicators we are following. In short-term technical analyses, the region between 21 (21593) and 233 (21456) period exponential moving averages, supported by the 21400 – 21600 zone, stands out as an important reference point. As long as it remains above this area, the upward movement is likely to continue. If positive movements persist, an advance towards the levels of 21820 and 21900 could be observed.

Support :

Resistance :