GBPUSD

While PMI and private sector employment data related to the service sector are being announced in the middle of the week, important developments such as the Bank of England's (BoE) interest rate decision (a 25 basis point cut) and unemployment claims from the US will be closely monitored today. Additionally, speeches from Waller and Daly from the Fed will also be noteworthy. On Friday, US employment data, including non-farm payrolls, the unemployment rate, and average hourly earnings, will be considered.

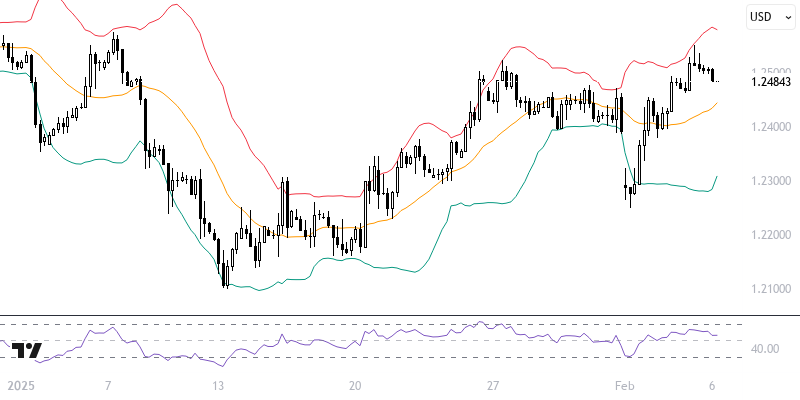

The GBPUSD pair is trading above the 233-period moving average ahead of the critical BoE decision. With the recent optimism, the negative outlook may have come to an end. However, for the pair to maintain this positive position, the support level in the 1.2440 – 1.2480 range needs to be upheld. If the pair manages to stay above this range, it may move towards the levels of 1.2525, 1.2565, and 1.2615. Otherwise, there is a risk of a return to the 1.2440 – 1.2480 range.

Support :

Resistance :