GBPUSD

The most notable developments during the central bank meeting in February occurred with the decisions made by the Bank of England (BoE). In line with market expectations, the BoE implemented a 25 basis point cut, drawing attention as all nine members supported the reduction. However, the demand from two members for a 50 basis point cut created a different dynamic in the markets. Although the pound experienced a decline after the vote, it later attempted to recover to pre-rate levels. Additionally, the U.S. employment data following the BoE will be a significant focus for global markets.

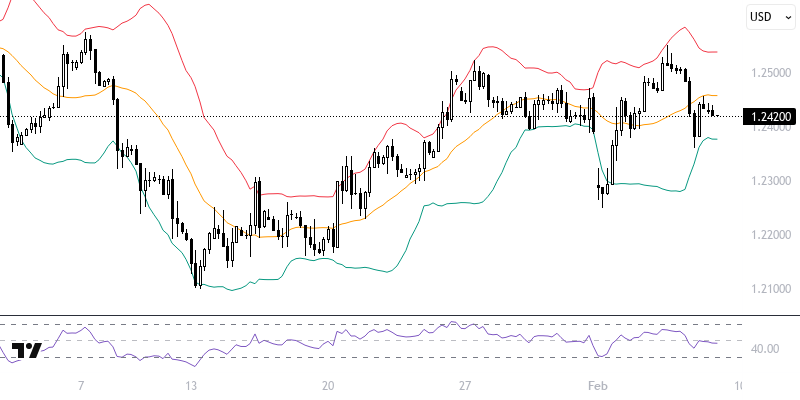

Despite approaching the 110 level, the Classic Dollar Index remains under pressure as it has not shown sufficient reaction in this zone. Short-term indicators are trading below the 34-day average (107.80), while optimism remains above the key indicator, the 233-day exponential moving average (105). Meanwhile, the GBPUSD exchange rate is fluctuating between 1.2395 and 1.2480, with sustained movements outside this range being critical for determining a clearer direction.

Support :

Resistance :