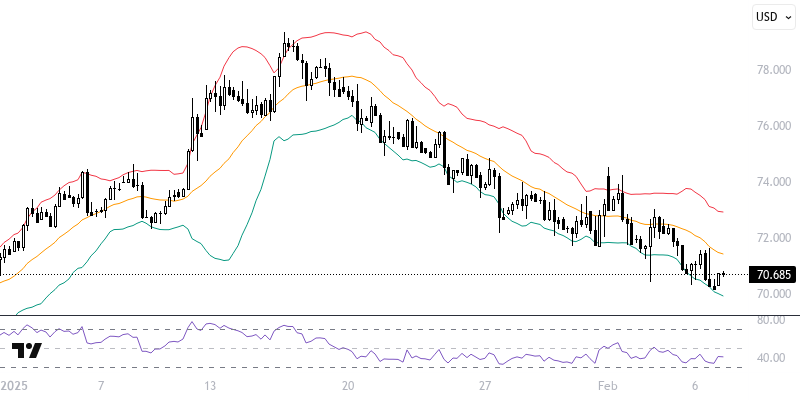

WTIUSD

Oil futures continue to show a downward trend due to expectations that demand from China will weaken because of tariffs imposed by Trump, despite the sanctions the U.S. has placed on Iran. Today, movements in European and U.S. stock markets, along with U.S. employment data, should be closely monitored.

As long as prices remain below the resistance levels of 71.00 – 71.50, a bearish trend may prevail. In case of a decline, the targets could be 70.50 and 70.00 levels. If a recovery occurs, new potential for declines could form as long as the resistance levels of 71.00 – 71.50 remain valid. In this context, movements and hourly closes above 71.50 will be crucial for the continuation of the upward momentum. In such a scenario, levels of 72.00 and 72.50 may come into focus. The key level for the day is 71.00 – 71.50.

Support :

Resistance :