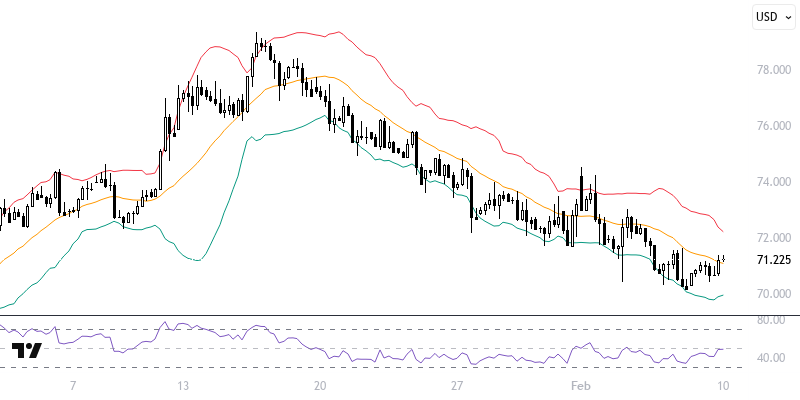

WTIUSD

Oil futures started the new week on a high note due to the impact of new U.S. sanctions. Following last week's sanctions on Iran, attention is now drawn to tariff commitments related to global aluminum and steel imports. Additionally, tariffs previously announced by China against the U.S. came into effect today. Movements in European and U.S. stock markets may be monitored throughout the day.

If prices remain below the resistance levels of 71.50 – 72.00, a downward trend may be prominent. In the event of a decline, levels of 71.00 and 70.50 could be targeted. However, if prices continue to stay within the range of 71.50 – 72.00, a new potential for decline could emerge. Therefore, it is important to monitor movements and hourly closures above 72.00 to sustain the upward momentum. In that case, levels of 72.50 and 73.00 may come into focus. The critical level for the day is 71.50 – 72.00.

Support :

Resistance :