NDXUSD

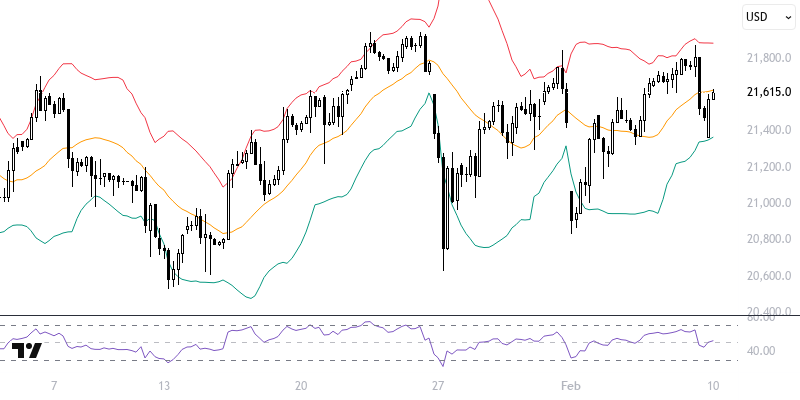

The announcement by U.S. President Donald Trump regarding a 25% tariff on steel and aluminum imports has led to significant effects in the markets. Following this decision, a limited decline in U.S. 10-year Treasury yields was observed, while the NASDAQ 100 Index experienced increases. The index is trading in a critical zone supported by the technical indicators we are monitoring.

From a short-term pricing perspective, the 21 and 233-period exponential moving averages support the 21500 – 21700 range, which is an important area for decision-making scenarios. To maintain positive expectations, it is necessary for prices to remain consistently above the 21700 level. In the event of potential recoveries, the 21820 and 21900 levels can be monitored, while falling below the 21500 level could bring negative scenarios into play. Among today's critical levels, the 21500 – 21700 range stands out.

Support :

Resistance :