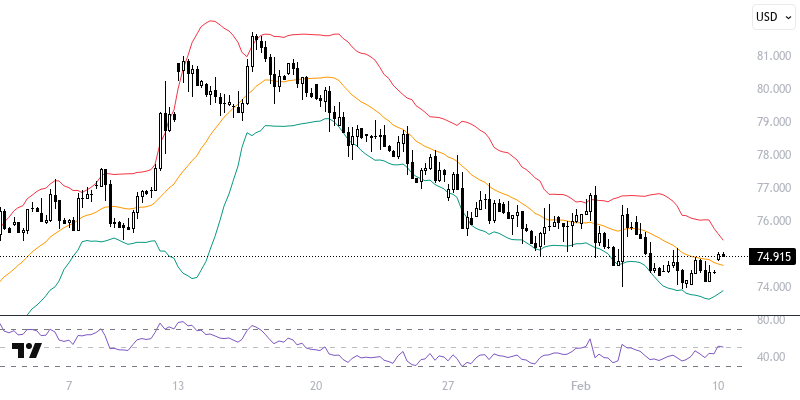

BRNUSD

Oil futures started the new week with an upward trend due to the impact of the new sanctions imposed by the U.S. Following sanctions on Iran last week, tariff commitments on global aluminum and steel imports have come to the forefront. Additionally, tariffs previously announced by China against the U.S. went into effect today. Throughout the day, movements in European and U.S. stock exchanges may be closely monitored.

If prices remain below the resistance level of 75.00 – 75.50, a downward trend could prevail. In the event of a decline, levels of 74.50 and 74.00 may be targeted. If a recovery occurs in prices and the 75.00 – 75.50 resistance holds, a new potential for decline may emerge. In this context, it is important to monitor the movement above 75.50 and hourly closings; in this case, levels of 76.00 and 76.50 may come into play. The critical level for the day: 75.00 – 75.50.

Support :

Resistance :