EURUSD

In the challenging economic conditions of Europe, the effects of the coalition that will emerge after the Federal Elections in Germany are a subject of curiosity. Next week, we will continue to monitor developments in the Eurozone, starting with the German IFO data, which fell below expectations. Additionally, the Q4 growth data from Germany and the speech of BUBA President Nagel will be significant. From the United States, the S&P/CS Housing Price Index and Conference Board Consumer Confidence data are anticipated.

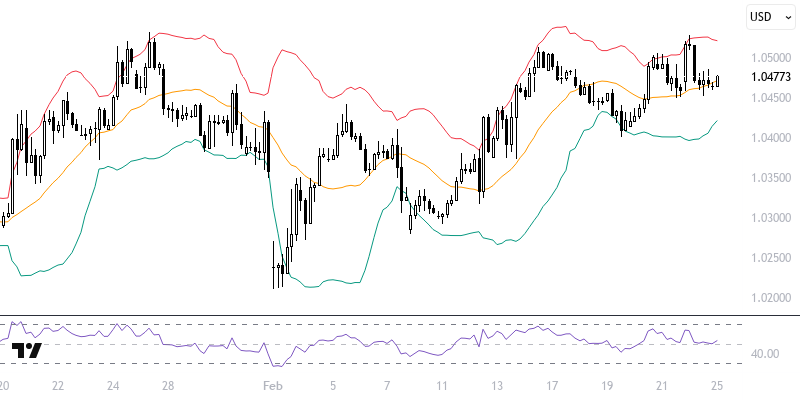

From a technical perspective, the EURUSD pair highlights the 1.0425 – 1.0460 range as a critical zone. If the pair remains above this level, it may move towards 1.0485, 1.0513, and 1.0542. Movements at the 1.0513 level will be decisive in determining whether it is a potential reaction sell-off or a trend rally. The 1.0425 – 1.0460 range serves as a strong short-term support.

Support :

Resistance :