GBPUSD

Europe is eagerly awaiting the effects of the coalition that will emerge after the Federal Election in Germany amid a challenging economic environment. Starting next week with the German IFO data falling short of expectations, the market will further examine the economic situation of the Eurozone with Germany's Q4 Growth (Final) data and a speech by BUBA President Nagel today. On the U.S. side, the S&P/CS Housing Price Index and Conference Board (CB) Consumer Confidence data are among the important developments.

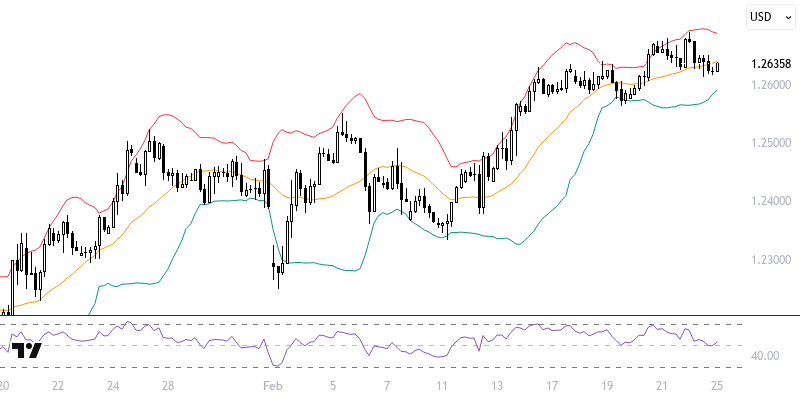

While the Dollar Index shows overall optimism above the 233-day exponential moving average, trading below the 34-day average keeps short-term rebound thoughts in the spotlight. The GBPUSD pair continues its movement at the upper point of the 1.2570 – 1.2620 range. If the support level at 1.2620 is maintained, the likelihood of a positive movement in the pair increases. Levels 1.2675, 1.2715, and 1.2760 should be closely monitored for potential trend volatility.

Support :

Resistance :