NDXUSD

The NASDAQ100 Index continues its downward movement despite the decline in U.S. 10-year Treasury yields, influenced by negative developments in the technology and artificial intelligence sectors. Among stock prices, Palantir experienced a sharp drop of 10.5%, while Nvidia saw a 3.1% decline ahead of its earnings report due on Wednesday. Microsoft lost 1% due to concerns over slowing data center expenditures. Throughout the day, Conference Board consumer confidence and Richmond Fed manufacturing index data will be monitored.

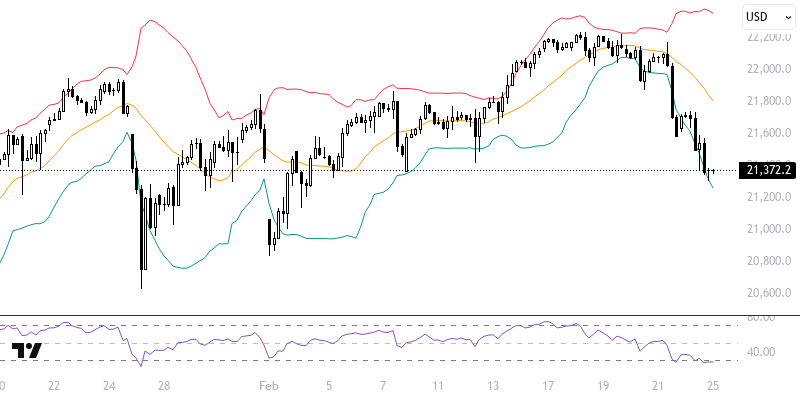

The NASDAQ100 index is trading below the level supported by the following indicators. In short-term technical analysis, as long as it remains below the 21700 – 21900 region, supported by the 21 (21804) and 233 (21696) period exponential moving averages, a negative outlook is likely. If the pullback continues, movements towards the 21400 and 21300 levels may be observed. For a positive trend to emerge, sustained pricing above the 21700 – 21900 region is necessary, which could bring the 22000 and 22100 levels into focus. The critical level of the day: the 21700 – 21900 region.

Support :

Resistance :