GBPUSD

In an environment where price reactions below the 106 level are not being observed, the partial recovery and calm pricing behavior experienced this week are limiting the movements of the EURUSD and GBPUSD pairs. With the start of critical news flow for the classic Dollar Index in the new week, an increase in volatility is expected until March 20. Today, speeches by Fed members Bowman, Schmid, Hammack, and Harker will be closely watched, alongside data on the US 4th Quarter Growth, Unemployment Claims, Durable Goods Orders, and Pending Home Sales.

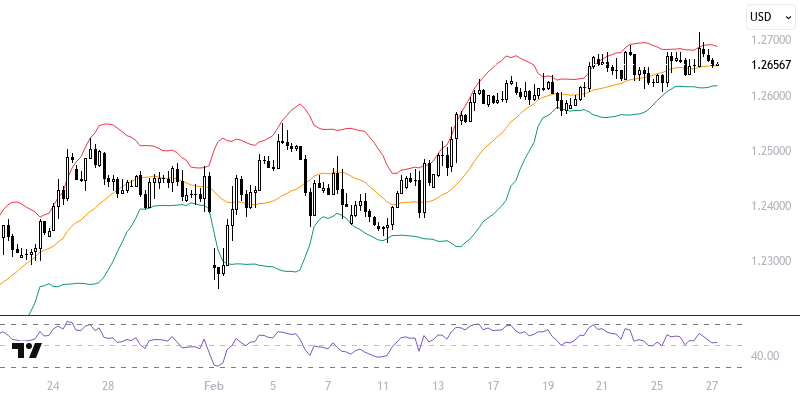

The GBPUSD pair is attempting to maintain a short-term positive movement by considering the 1.2570 – 1.2620 zone as a bottom point. In this context, an increase towards the levels of 1.2675, 1.2715, and 1.2760 can be observed. Particularly, a sustained movement above the 1.2675 level could support a trend towards the peak of 1.2810, reached on December 6, 2024. Otherwise, a reaction towards the reference zone may occur.

Support :

Resistance :