XAUUSD

On Wednesday, U.S. President Trump proposed a 25% reciprocal tariff on cars and products originating from the European Union. It was announced that the tariffs imposed on Mexico and Canada will take effect on April 2 instead of March 4. These developments allow the Dollar Index to continue its gains, while gold remains under pressure despite the increasing uncertainty. Throughout the day, leading growth rates, unemployment claims, durable goods orders, and speeches from FOMC members will be closely monitored.

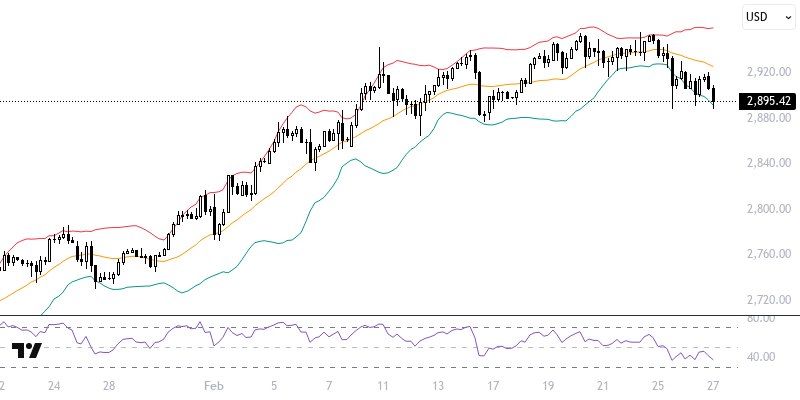

Gold is trading within a range supported by the indicators we are monitoring in the short term. As long as the precious metal remains within the 2900 – 2920 range, the decision-making scenario will remain valid. To strengthen positive expectations, sustained pricing above 2920 may be needed. In potential recoveries, levels of 2930 and 2942 could come into focus, while maintaining a negative scenario requires staying below 2900. In declines, we might encounter levels of 2890 and 2877. The key level of the day is: the 2900 – 2920 range.

Support :

Resistance :