NDXUSD

Nvidia reported a net profit in the fourth quarter, showcasing better-than-expected financial performance and projecting a 78% annual revenue increase. However, despite these positive developments, limited pricing was observed in the markets. The proposal by U.S. President Trump for a 25% tariff on automobiles and products from the European Union, coupled with a decline in U.S. 10-year Treasury yields and Nvidia's strong financial results, exerted pressure on the NASDAQ100 Index. Throughout the day, leading growth rates, unemployment claims, durable goods orders, and statements from FOMC members will be monitored.

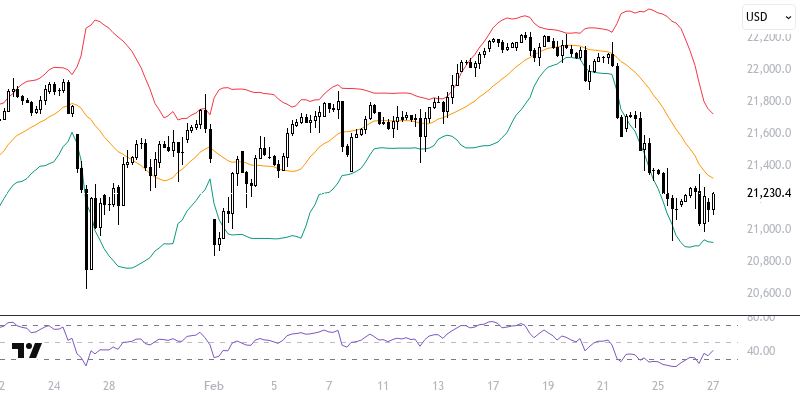

The NASDAQ100 index is trading below technically supported levels. As long as it remains below the 21300 – 21400 area, supported by the 21-period exponential moving average, the negative outlook may persist. If the downward trend continues, a movement towards the levels of 21100 and 20975 can be expected. Alternatively, sustained pricing above the 21300 – 21400 area could create a positive trend, in which case levels of 21500 and 21600 may come into focus. Important level: 21300 – 21400 area.

Support :

Resistance :