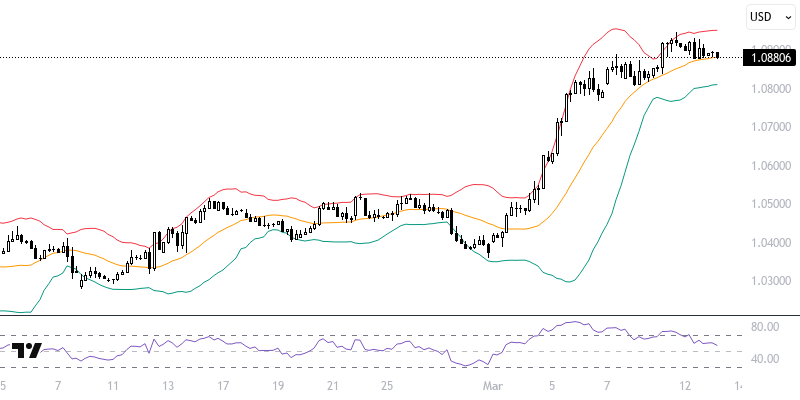

EURUSD

Recent concerns about recession focused on the Fed have intensified with the U.S. inflation (CPI) data for February falling short of expectations. The Fed meeting scheduled for March 19 will be a critical turning point for market expectations. The FOMC Economic Projections and Chairman Powell's statements will provide an important roadmap for assessing currency trends in the second quarter. Additionally, ECB President Lagarde's remarks about inflation potentially fluctuating due to external shocks keep alive expectations for a quarter-point interest rate cut at the April meeting.

The recent declines in the Dollar Index indicate a tug-of-war between short-term sellers and medium-term buyers. Developments until March 19 could offer significant clues about the second quarter of the year. In the EURUSD pair, the 1.0760 level serves as critical support, while the 1.0920 level will be decisive for the sustainability of the upward trend. In the event of a potential reaction, 1.0760 emerges as the main support, and sustained movements below this level could introduce new pressure scenarios.

Support :

Resistance :