EURUSD

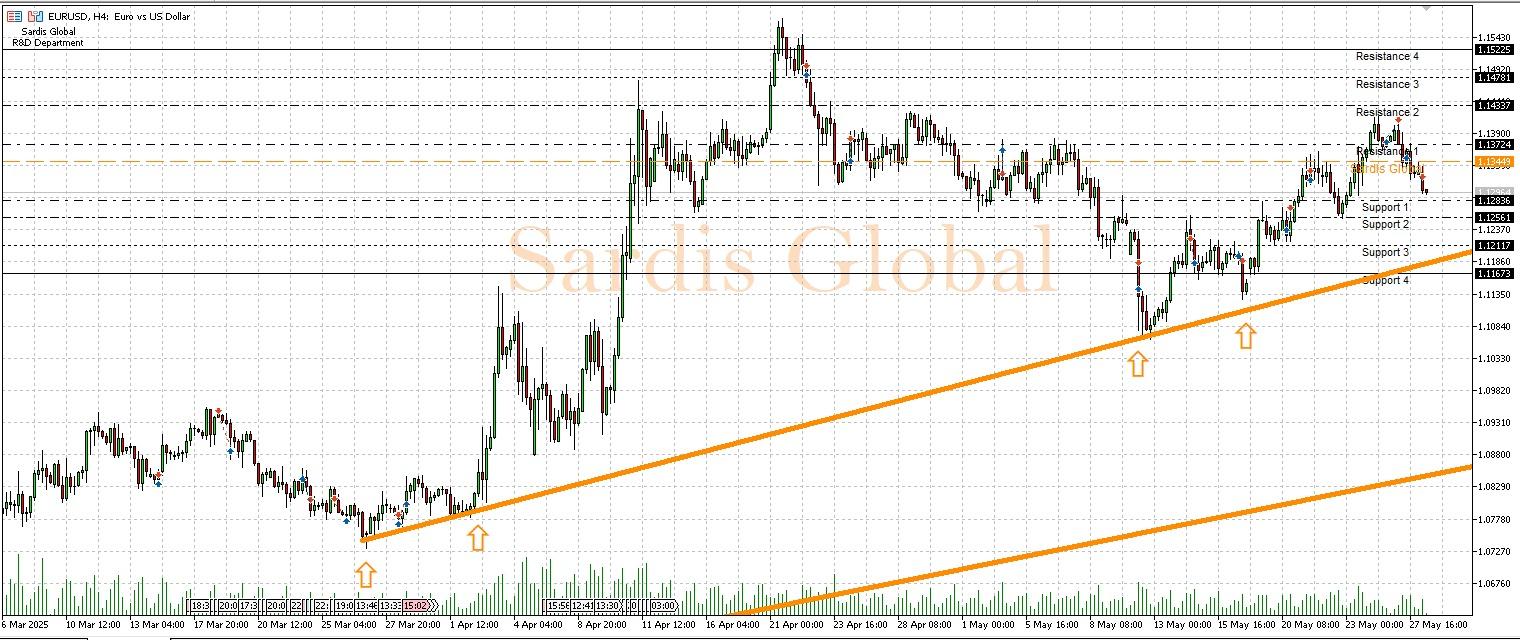

The EURUSD pair spent the first day of the week, Monday, with low volume due to holidays in the US and the UK, and then on Tuesday, the dollar strengthened somewhat with the US CB Consumer Confidence data released, which came in well above expectations at 98.0. This situation has the potential to keep the pair below the 1.13449 pivot level. The most critical development of today will be the release of the FOMC meeting minutes in the evening. Hawkish messages from the minutes and a determined stance against inflation could further strengthen the dollar, pulling the EURUSD towards the support levels of 1.12836 (S1) and then 1.12561 (S2). In the case of a dovish tone or concerns about economic slowdown taking precedence, the pair could test the resistance at 1.13724 (R1) and move towards the 1.14337 (R2) level. The US GDP data on Thursday and the Core PCE data on Friday will also be other important factors determining the direction for the remainder of the week.

Support :

Resistance :