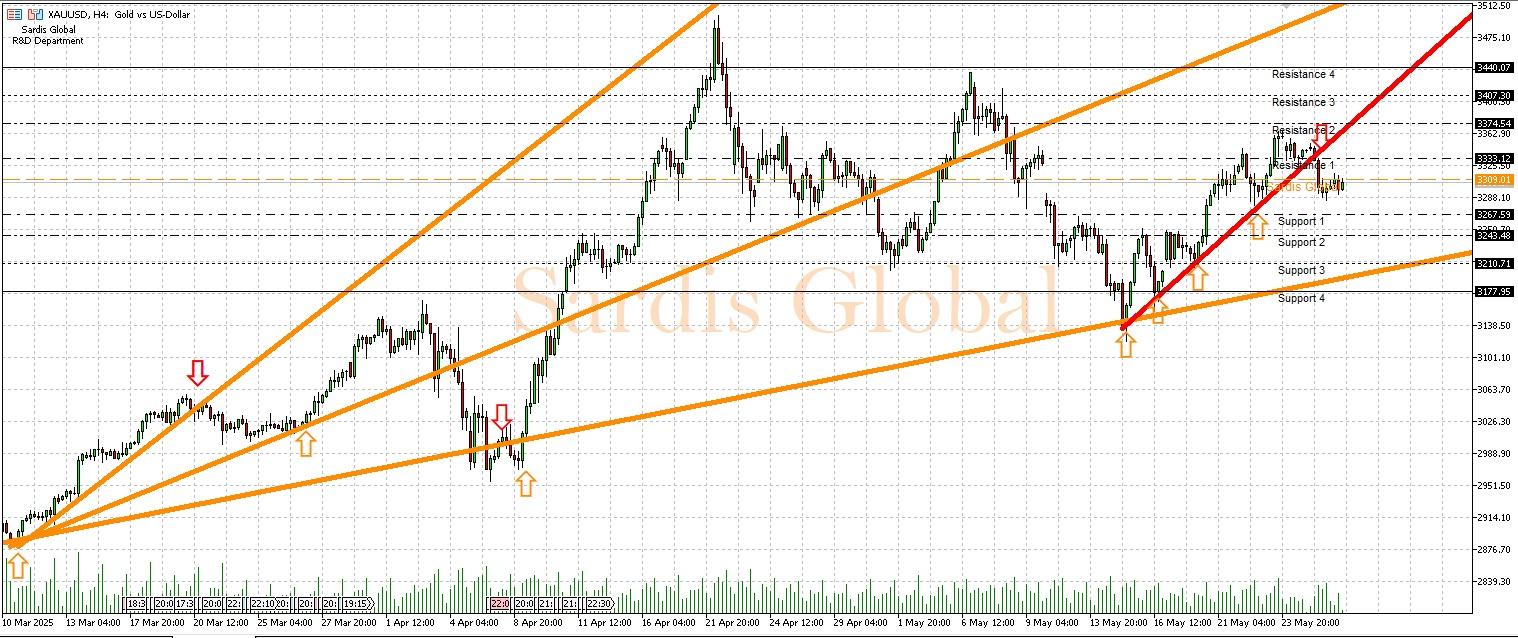

XAUUSD

Gold started the week cautiously following Fed Chairman Powell's speech on Sunday, while the strong US Consumer Confidence data released on Tuesday supported the dollar, putting some pressure on gold. This situation may keep gold below the 3309.01 pivot level. The FOMC meeting minutes to be released this evening are of great importance for the short-term direction of gold. If the minutes contain hawkish signals indicating that the Fed may continue its interest rate policy, gold could pull back towards the support levels of 3267.59 (S1) and 3243.48 (S2). If the minutes are more dovish, the precious metal could break above the resistance level of 3333.12 (R1) and target 3374.54 (R2). The US Core PCE data to be released on Friday will also impact gold prices through inflation expectations.

Support :

Resistance :