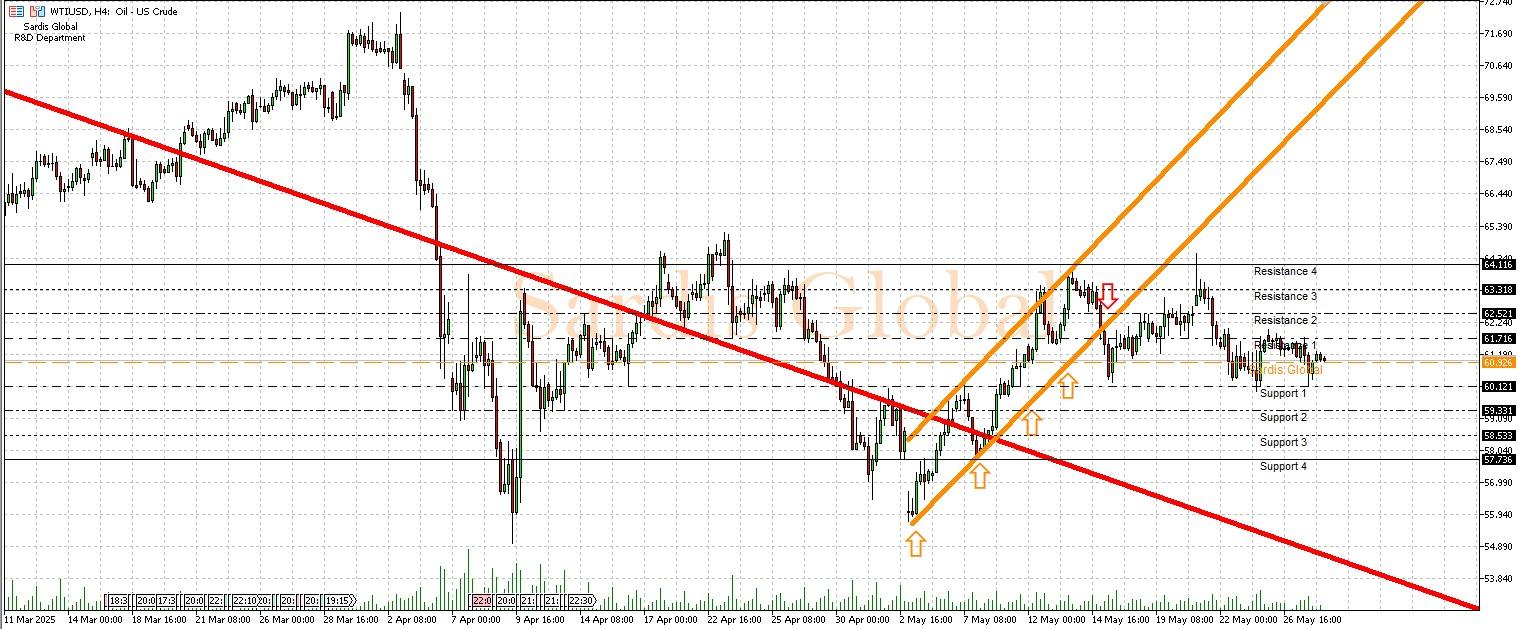

WTIUSD

Crude oil prices are focused on global economic data following a low-volume session due to Monday's holidays. The strong U.S. consumer confidence data released on Tuesday may be seen as a positive signal for demand, while markets will mainly pay attention to the U.S. Energy Information Administration (EIA) Crude Oil Inventories and U.S. GDP data set to be announced on Thursday. The current pivot level is 60.926. A larger-than-expected decline in inventories or strong GDP data could push oil prices towards resistance levels of 61.716 (R1) and 62.521 (R2). On the other hand, an increase in inventories or signs of weak economic growth could pressure prices towards support levels of 60.121 (S1) and 59.331 (S2). The Manufacturing PMI data from China expected on Saturday will also be monitored for the global demand outlook.

Support :

Resistance :