EURUSD

The Classic Dollar Index maintains its medium-term optimism despite the reactionary outlook that began at the 110 level. In the weekly bulletin, we emphasized the critical importance of the 106.45 – 105.70 range, where the 21-week average is located. On the fourth trading day of the week, the index's attempt to form a bottom after reaching the 106.45 level draws attention. In the remaining days, we will monitor whether the trend remains above this critical area. This will also play a decisive role in determining whether potential rises in EURUSD and GBPUSD will come to an end.

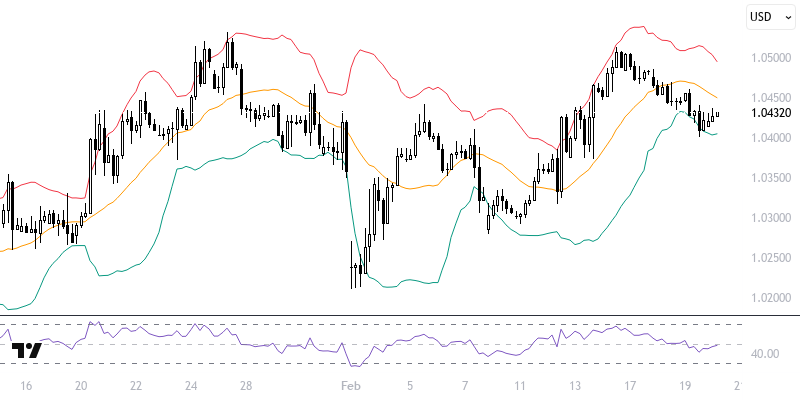

After slightly exceeding the 1.05 level, the EURUSD pair has come under pressure due to the recovery in the DXY. If a reversal occurs in the DXY, caution is advised against downward pressures on the pair. Technically, sustained movements below the 1.0410 – 1.0435 region, where the 55 and 233-period averages are located, are required for these pressures. In this case, the 1.0175 low may come back into focus. While no breakout has occurred yet, we will continue to follow the decision phase in this region.

Support :

Resistance :