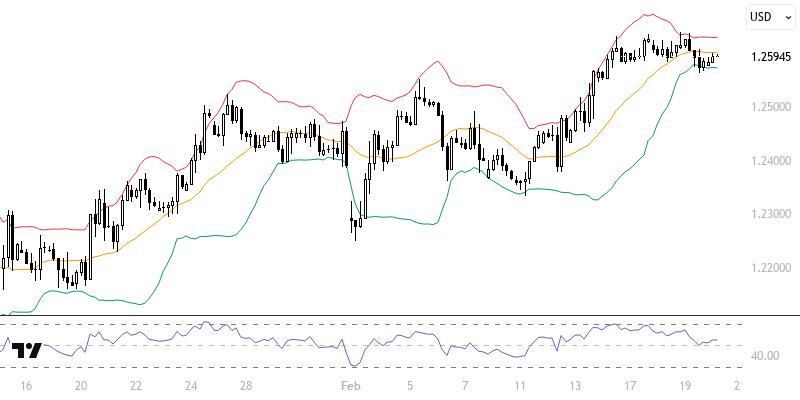

GBPUSD

Despite the reaction starting from the level of 110, the medium-term outlook for the Classic Dollar Index remains optimistic. In the weekly bulletin, we emphasized that the range of 106.45 – 105.70, where the 21-week average is located, is a critical level. On the fourth trading day of the week, the index is attempting to form a bottom after reaching the 106.45 level. In the remaining days, we will monitor whether the index can maintain its trend above this critical area. This situation will be an important indicator of whether the rises in EURUSD and GBPUSD have come to an end.

The GBPUSD pair experienced some pressure due to the recovery in DXY after reaching the level of 1.2620. If the expected reversal in DXY occurs, it will be necessary to be prepared for downward pressures on the pair. Technically, sustained movements below 1.2570 should be observed for such pressure. In this case, the 1.2480 area, where the 144 and 233-period averages are located, could become significant. Although no break has occurred yet, the pair is trying to decide within the 1.2570 – 1.2620 band.

Support :

Resistance :