BRNUSD

Oil futures have been subject to profit-taking following the American Petroleum Institute's report of a larger-than-expected increase in inventories. This week, an increase of approximately 3.4 million barrels was recorded after last week's rise of over 9 million barrels. The decision by OPEC+ to increase production in April remains uncertain. Additionally, there has been no response from Turkey regarding speculation that oil trade from northern Iraq might resume. Ceasefire negotiations in Ukraine are also ongoing in an unclear manner. Throughout the day, movements in European and U.S. stock markets, along with inventory data to be released by the U.S. Energy Information Administration, can be closely monitored.

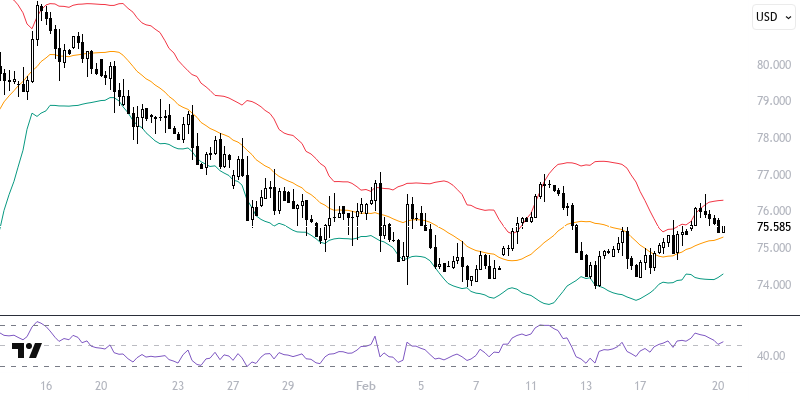

If prices remain below the 76.00 resistance, a downward trend may emerge. In potential declines, levels of 75.50 and 75.00 can be targeted. For any recoveries, it is essential to maintain the 76.00 resistance; otherwise, levels of 76.50 and 77.00 could come into play. The 76.00 level stands out as a critical point for the day.

Support :

Resistance :