EURUSD

On Thursday, with the European Central Bank's (ECB) Interest Rate Decision and President Lagarde's speech, the Classic Dollar Index continues to remain below 107, the 34-day average, ahead of the U.S. employment data to be announced on Friday. This situation has caused the main index to approach the 233-day exponential moving average (105.25). The critical developments of the week are eagerly awaited to see how they will affect general trend conditions. Today, ADP Private Sector Employment and ISM Services PMI data will be closely monitored.

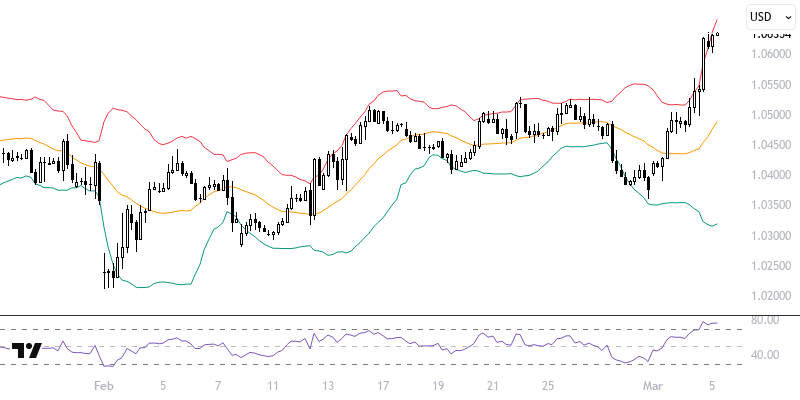

In the EURUSD pair, a significant positive reaction was observed as it broke above the upper limit of the 1.0375 – 1.0535 band, influenced by a weak Dollar and a strong Euro. This situation has revised the short-term outlook for the pair positively. 1.0535 has now become a critical support level, and as long as it stays above this level, targets of 1.0640, 1.0680, and 1.0720 may come into play. Sustained movements below 1.0535 could invalidate the current scenario, potentially leading to renewed pressure toward the 1.0375 level. Key levels: 1.0535 and 1.0640.

Support :

Resistance :