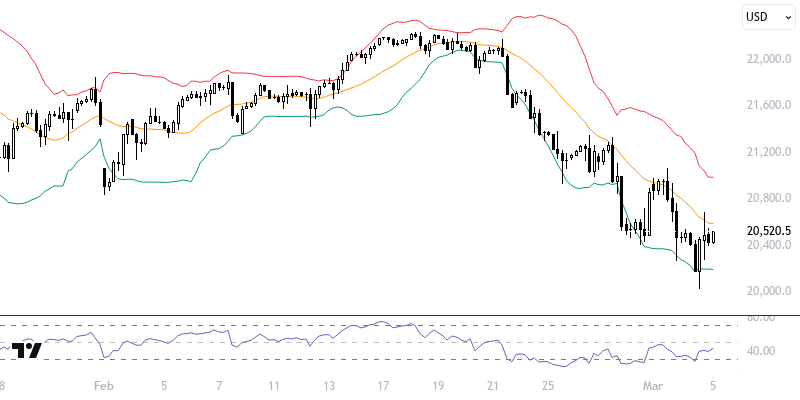

NDXUSD

President Trump's implemented tariffs continue to have significant effects on the markets. Trade Secretary Lutnick's proposal for tax reductions for Canada and Mexico has alleviated risk perception and somewhat reduced inflation concerns. Additionally, the market's expectation of three interest rate cuts from the Fed and the limited increase in U.S. 10-year Treasury yields have helped suppress the desire for a decline in the NASDAQ 100 Index. Throughout the day, ADP non-farm payroll changes and ISM services PMI data are being closely monitored.

The NASDAQ 100 Index is trading below its support level. In short-term technical analysis, the expectation of a decline remains prominent as long as it stays below the 20680 – 20785 region supported by the 21-period exponential moving average. If the pullback continues, a movement towards the 20420 and 20250 support levels may occur. For a positive scenario, sustained pricing above the 20680 – 20785 region will be necessary.

Support :

Resistance :