XAUUSD

President Trump's statements on tariffs continue to impact the markets. U.S. Secretary of Commerce Lutnick's proposals for tax reductions for Canada and Mexico have eased risk perception and somewhat alleviated inflation concerns. Additionally, the market's expectation of three interest rate cuts from the Fed by the end of the year, along with the decline in the Dollar Index, has helped gold prices remain above the 2900 level in the short term. Later in the day, ADP non-farm employment change and ISM services PMI data will be followed.

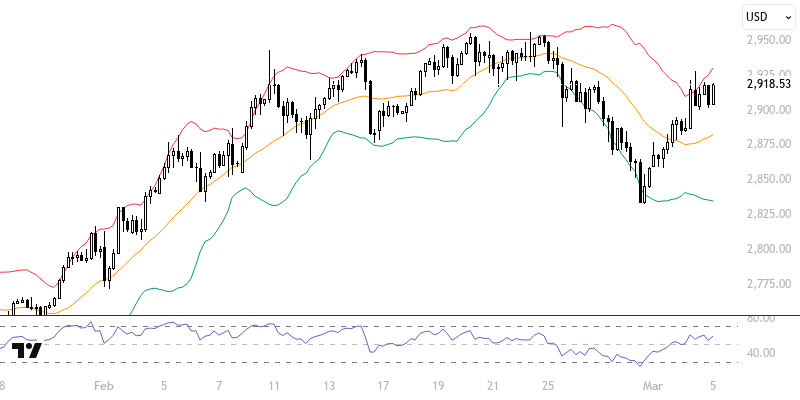

As long as the precious metal stays within the 2890 – 2900 range, an upward expectation may prevail. If the rise continues, levels of 2920 and 2930 could be seen. However, for a negative trend, sustained movement below the 2890 – 2900 zone may be necessary; in that case, a move towards 2877 and 2870 levels could occur. The critical level for the day: the 2890 – 2900 range.

Support :

Resistance :