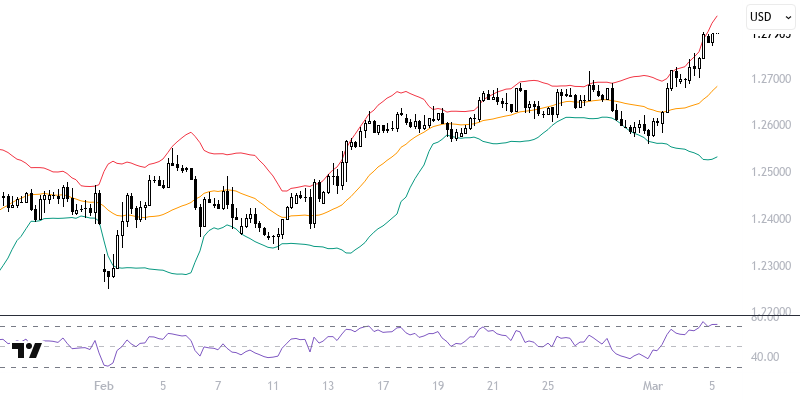

GBPUSD

On Thursday, the European Central Bank's (ECB) interest rate decision and President Lagarde's speech will be a significant turning point before the U.S. employment data to be released on Friday. The Classic Dollar Index continues to exert pressure below its 34-day average (107), bringing its decline closer to the 233-day exponential moving average (105.25) of the main index. We will closely monitor these developments, which will affect changes in overall trend conditions. Today, the ADP Private Sector Employment and ISM Services PMI data will be in focus.

In the GBPUSD pair, the 1.2675 interim support level is critically important in the short term. The pair's desire to stay above this level could allow it to move towards resistance levels like 1.2810, 1.2855, and 1.2900. Sustained movements above the December 16, 2024 peak at 1.2810 could strengthen the bullish sentiment. However, if there is pressure in the interim support zone, the main expectation remains to stay positive above the 1.2525 – 1.2570 levels.

Support :

Resistance :