EURUSD

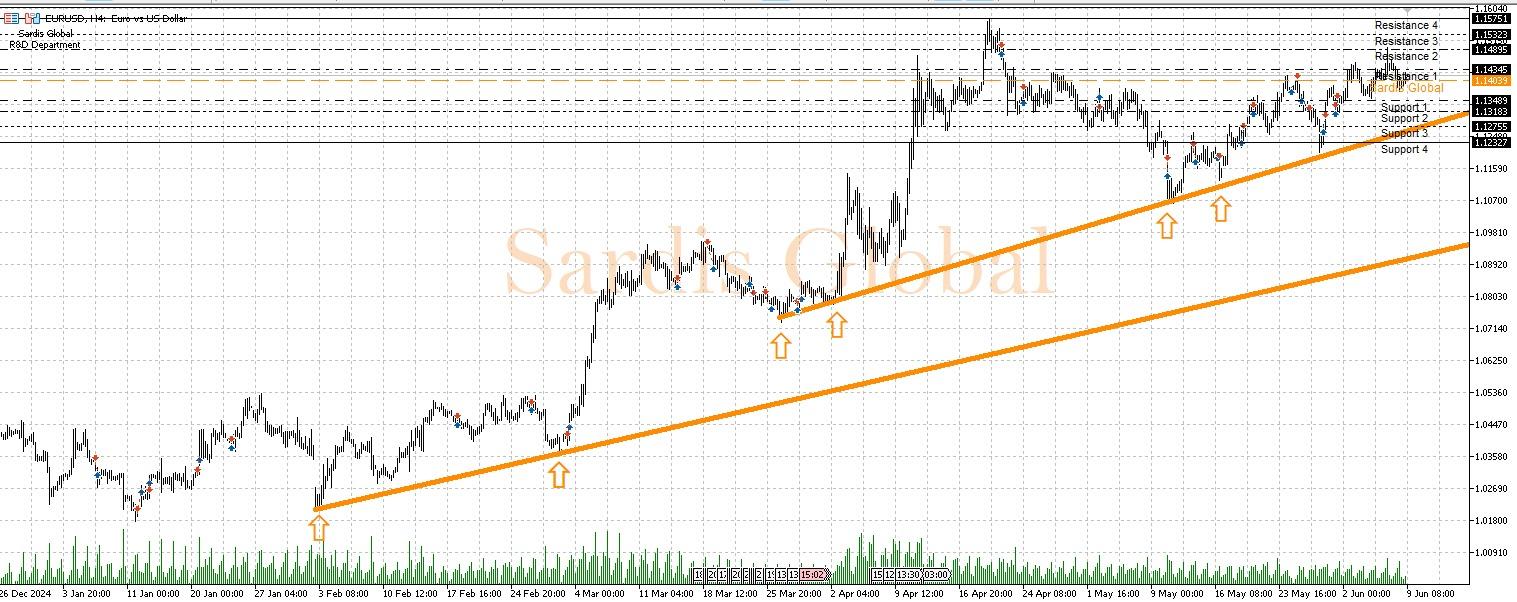

The most significant development that will be decisive for the EURUSD pair this week is the Consumer Price Index (CPI) data coming from the U.S. on Wednesday. After a calm start to the week and the holidays on Monday, the markets will focus on the inflation data (U.S. CPI) that will guide the Fed's interest rate path. A CPI figure that comes in above expectations could lead to a global strengthening of the dollar, creating selling pressure on the pair. In this case, the pivot level of 1.14039 could be broken, targeting the support levels of 1.13489 (S1) and 1.12755 (S3). Conversely, a figure that falls below expectations could reinforce the expectation that the Fed may soon end its rate hike cycle, potentially pushing the pair to the resistance levels of 1.14345 (R1) and 1.14895 (R2). On Friday, the CPI data from Germany could cause volatility on the Euro side of the pair. It is anticipated that pullbacks will remain limited depending on the trend, and the upward movement may continue.

Support :

Resistance :