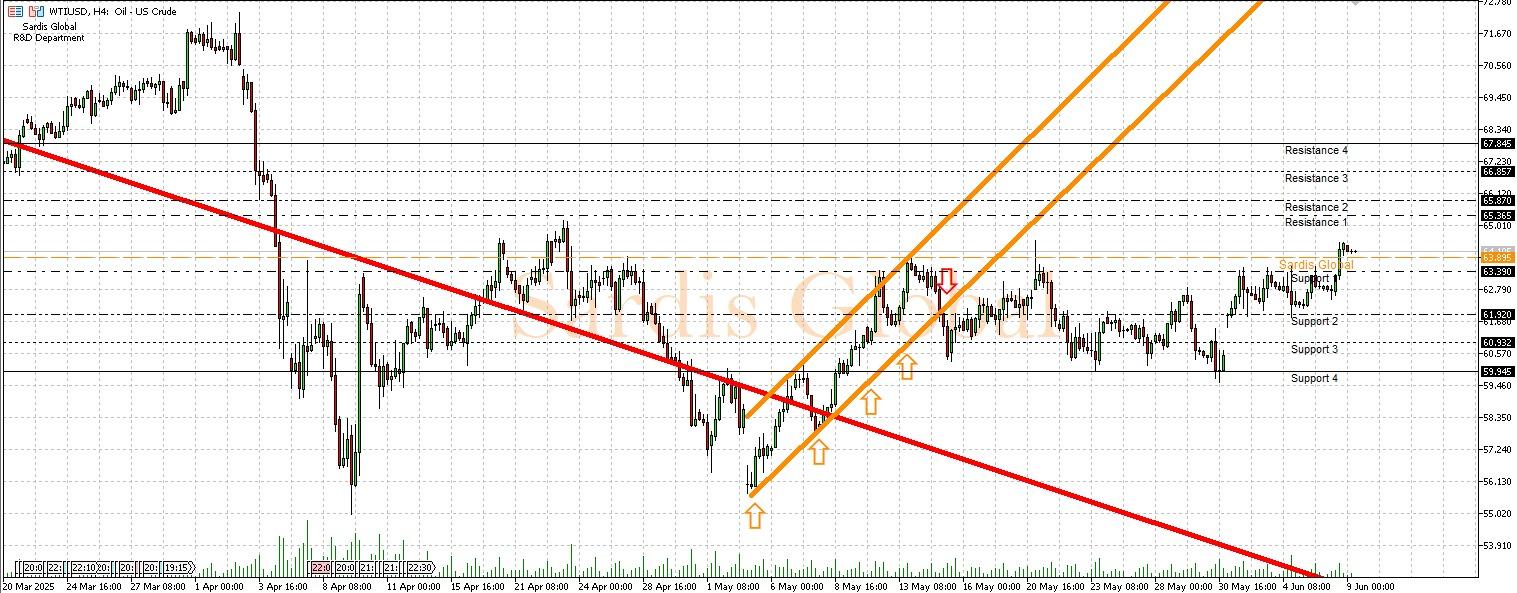

WTIUSD

This week, two key dynamics are emerging for crude oil prices: the impact of economic data from the U.S. on demand outlook and the EIA Crude Oil Stocks data to be released on Wednesday. The most critical data of the week, the U.S. CPI, will provide a signal about the overall economic health. A strong perception of the economy supports demand, while concerns about weakness put pressure on oil prices. However, the more direct impact will come from the stock data to be announced on Wednesday. A larger-than-expected drop in stocks (more than -4.304M) similar to last week could indicate demand strength and push prices towards resistance levels of 65.365 (R1) and 65.870 (R2). An unexpected increase in stocks could be interpreted as demand weakness, leading to a test of support levels at 63.390 (S1) and 61.920 (S2).

Support :

Resistance :