NDXUSD

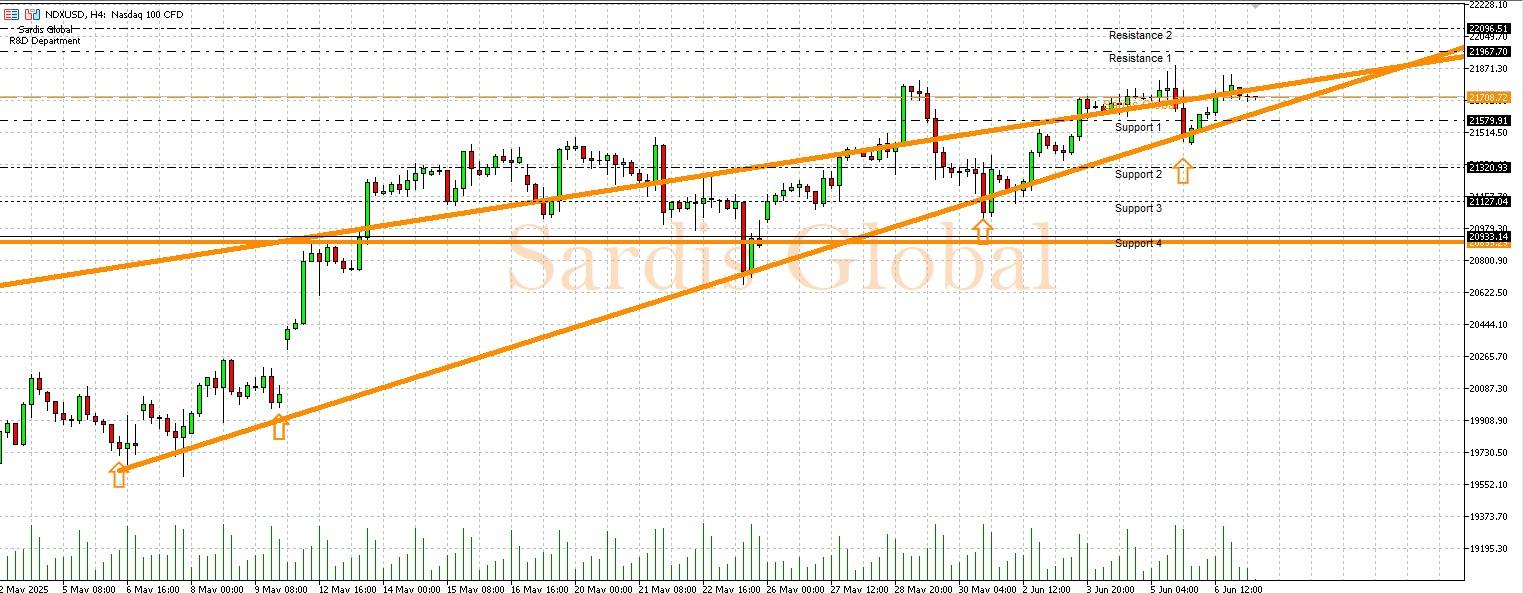

The Nasdaq Index, which is predominantly composed of technology and growth stocks, will continue to be one of the instruments most sensitive to interest rate expectations this week. The critical event of the week, the U.S. CPI data on Wednesday, will be decisive for the direction of the index. High inflation would directly pressure technology stocks, as it would imply further tightening by the Fed. If the data exceeds expectations, a sharp sell-off could be seen towards the support levels of 21579.91 (S1) and 21320.93 (S2) below the pivot level of 21708.72. Conversely, data indicating cooling inflation could trigger a rally in technology stocks, targeting the resistance levels of 21967.70 (R1) and 22096.51 (R2). The PPI data on Thursday will also be important in confirming this outlook.

Support :

Resistance :