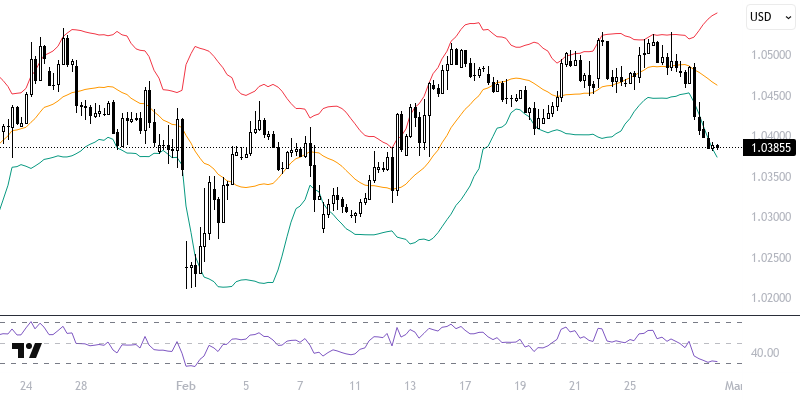

EURUSD

The general optimism above the 233-day exponential moving average (105.25) poses a challenge in maintaining the 106 level. The Classic Dollar Index has shown recovery, reaching the 34-day average (107.20). EURUSD has struggled above 1.05, and GBPUSD has faced resistance at 1.27, increasing concerns about DXY’s pressure. In March, key economic indicators such as Germany's CPI and the US Fed's PCE inflation data should be closely monitored.

Technically, EURUSD remains below the 55 and 233-period averages (1.0453 - 1.0427), indicating the end of the positive trend. Optimism in DXY may intensify the pair’s downward movement. If it stays below 1.0470, support levels at 1.0375, 1.0330, and 1.0270 could be tested. A break below 1.0375 may bring 1.0175 into focus. For a recovery, sustained movement above 1.0470 is necessary, or else a reaction towards 1.0640 might occur. Key levels: 1.0470 and 1.0375.

Support :

Resistance :