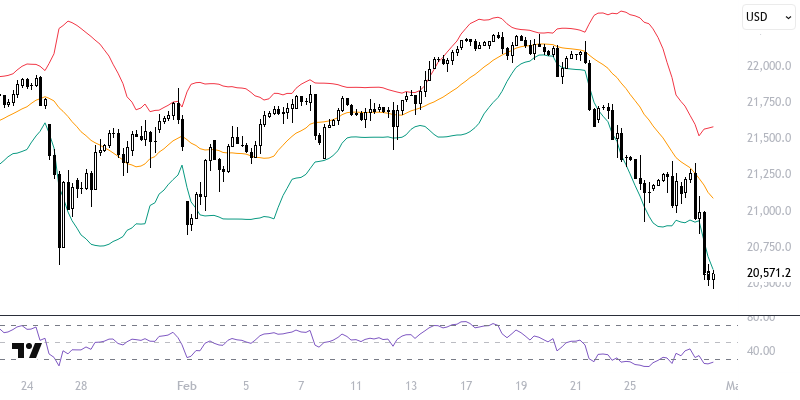

NDXUSD

On Thursday, U.S. President Trump announced that a 25% tariff on products from Mexico and Canada will be implemented starting March 4. On the same date, a 10% tariff on China will also come into effect. Despite growth figures aligning with expectations, negative results from some data, such as unemployment claims and core durable goods orders, caused a decline in 10-year Treasury yields. Despite the drop in benchmark bond yields, the NASDAQ100 Index experienced a loss due to pressures in the semiconductor sector. Throughout the day, the core PCE price index and Chicago PMI data will be monitored closely.

The NASDAQ100 index is trading below the region supported by the indicators we are monitoring. From a technical perspective, as long as the upward pressure is maintained below the range of 21100 – 21200, which is supported by the 21-period exponential moving average, the downward trend may continue. If the declines persist, a movement towards the support levels of 20520 and 20420 can be observed. In an alternative scenario, upward price movements will require 4-hour closes above the 21200 level.

Support :

Resistance :