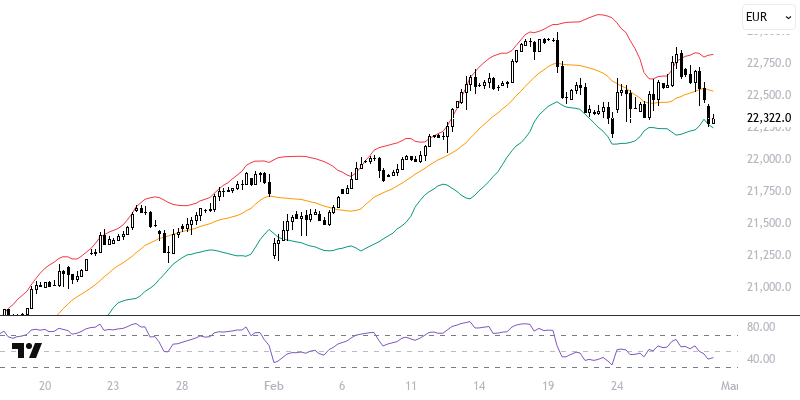

DAXEUR

We are at a significant turning point for the day, the week, and the month. The impressive performance of European stock markets has been evident throughout February. The UK has stood out with a 7% increase, while Italy has seen a 6% rise. The DAX40 index has provided over 13% returns since the beginning of the year and has shown a positive performance of around 4% this month. With the tariffs the US is set to impose on the EU, along with the geopolitical risks of Russia-Ukraine and the economic indicators coming in March, understanding the optimism or realization process in the markets is crucial when combined with the monetary policy decisions of central banks.

When we technically analyze the DAX40 index, we see that we are at a significant threshold in the reactive process that started from the 23000 peak. The Envelope indicator supporting the upward trend is passing through the 22215-22370 range, and the index is at a decision-making stage within this critical band. As long as it remains above this range, the likelihood of the trend continuing strengthens, while persistent movements below may lead to trend changes and a dip to the 21195 level. Therefore, the current state of the index should be monitored closely.

Support :

Resistance :