XAUUSD

On Thursday, U.S. President Trump announced that a 25% tariff on products from Mexico and Canada will take effect on March 4. It was also stated that a 10% tariff on China will be implemented on the same date. These developments have led to an increase in the Dollar Index while causing declines in gold prices. Throughout the day, core PCE price index changes and Chicago PMI data will be closely monitored.

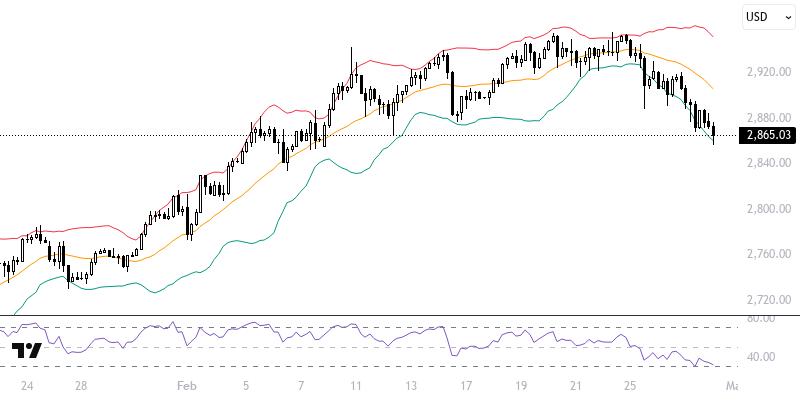

Gold is currently trading below the levels supported by the indicators being monitored in the short term. The precious metal is expected to continue its decline as long as it remains outside the 2890 – 2907 range. If the pullback continues, movements towards the support levels of 2860 and 2850 may be observed. In an alternative scenario, sustained pricing above the 2890 – 2907 range is necessary for a positive outlook; in this case, levels of 2920 and 2930 could be reached above 2907.

Support :

Resistance :