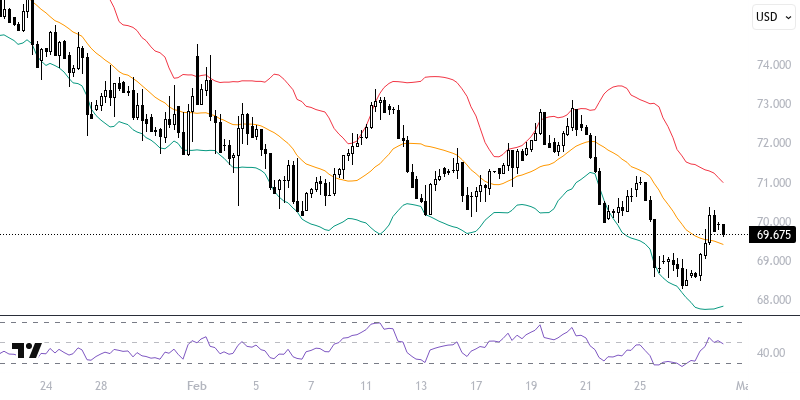

WTIUSD

Oil futures faced renewed selling pressure during the Asian session following concerns regarding supply. Trump's revocation of Chevron's operating license in Venezuela became an additional factor contributing to upward movements. However, the overall picture continues to reflect a strong supply and weak demand outlook. Movements in European and U.S. stock markets, along with U.S. PCE inflation data, may be significant developments throughout the day.

As long as prices remain within the range of 69.50 – 70.00, an upward outlook could prevail. In potential rallies, levels of 70.50 and 71.00 could be targeted. However, maintaining support at the 69.50 – 70.00 range will support new upward potential. For declines, it will be essential to monitor movements and hourly closes below 69.50, which may bring levels of 69.00 and 68.50 into focus.

Support :

Resistance :