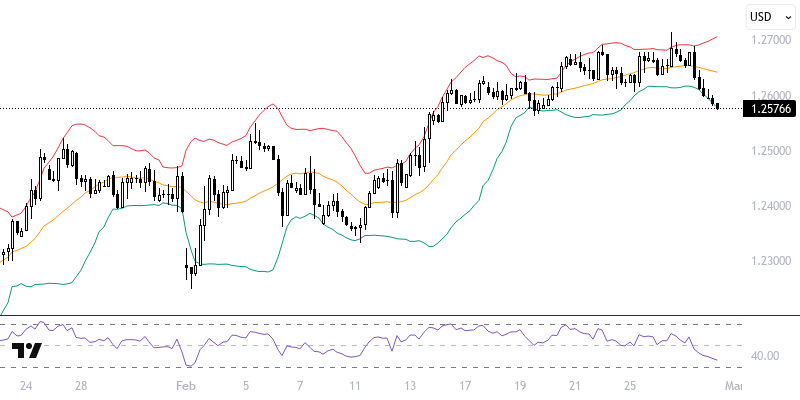

GBPUSD

The optimism above the 233-day exponential moving average (105.25) faces a challenge in maintaining the 106 level, while the Dollar Index’s recovery to the 34-day average (107.20) stands out. As EURUSD struggles above 1.05 and GBPUSD above 1.27, potential pressure on DXY is being observed. In March, we will assess whether switching from Euro and Pound to Dollar during rallies remains a viable strategy. Germany’s CPI and the U.S. Fed’s PCE data should be closely monitored as the week ends.

GBPUSD, influenced by the strong U.S. Dollar, is nearing the 1.2570 support level from 1.2715. While optimism in DXY dominates, GBPUSD remains in the positive zone. The 1.2525 - 1.2570 range is crucial; a sustained move below could shift the trend, targeting 1.21. However, no breakout has occurred yet. Key levels: 1.2525 - 1.2570.

Support :

Resistance :