NDXUSD

Following the Fed statement, the rise of U.S. 10-year Treasury yields to 4.25% led to declines in the NASDAQ 100 Index. However, this decline indicates limited changes in the spot market. Shares of leading companies such as Nvidia, Microsoft, Apple, Tesla, Amazon, Google, and Meta showed fluctuations of less than 1%. In the futures markets, there is a view that the index's declines are limited. The speech by FOMC member Williams during the day will be monitored.

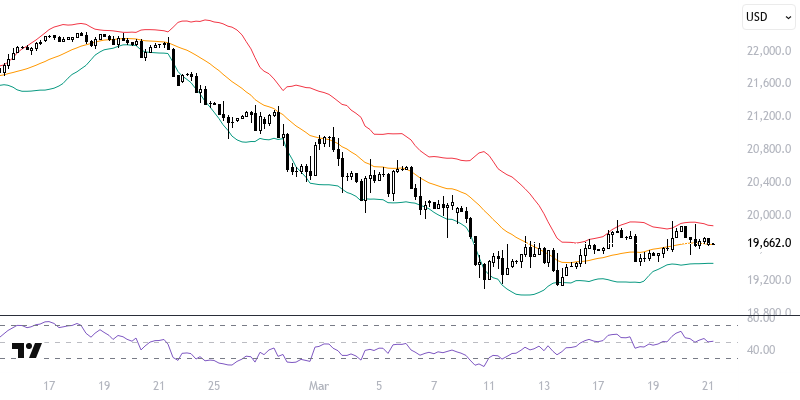

The NASDAQ 100 index is trading at a critical level supported by the indicators we are watching. In short-term pricing, maintaining the 19800 – 20000 range supported by the 21-period exponential moving average may play an important role in the decision-making phase. To strengthen positive expectations, sustained pricing above 20000 will be necessary.

Support :

Resistance :