GBPUSD

The Classic Dollar Index is at a significant turning point in the middle of the week, amidst a pause in the EURUSD and GBPUSD pairs. Critical data such as growth, employment, inflation, and central bank decisions are expected to influence the markets until March 20. During this period, increased data flow may lead to fluctuations in asset prices. The speeches of Fed representatives Barkin and Bostic, along with New Home Sales data, should be closely monitored today.

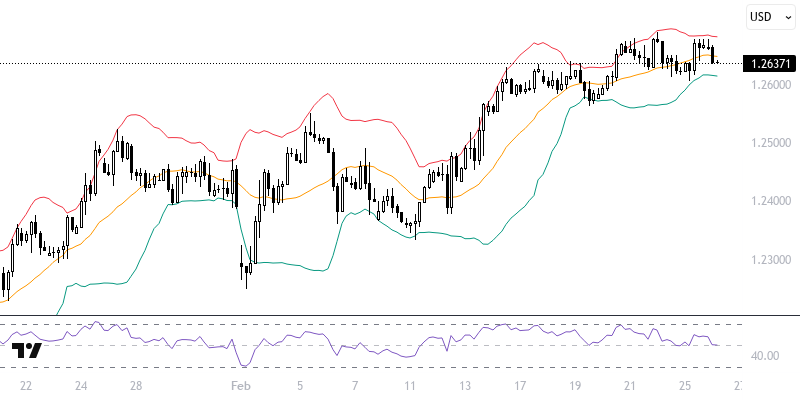

The GBPUSD pair is attempting to show a short-term positive movement, particularly considering 1.2620 as a support level while trading above the 1.2570 – 1.2620 range. Therefore, optimism prevails in the short-term outlook for the pair. A sustained move above 1.2675 could support an upward trend towards 1.2810. However, if the reference area is broken downwards, the exponential moving averages in the 1.2510 – 1.2525 range still provide an optimistic backdrop for the pair. Key levels: 1.2570 and 1.2675.

Support :

Resistance :