DAXEUR

European stock indices continue to attract the interest of investors with their remarkable performance since the beginning of the year. While this week has shown a mixed outlook, optimism remains at the forefront. Despite significant declines recorded in the EMEA region and pressure faced by Asia, Europe (excluding France) is following a positive trend. The Netherlands stands out with a performance exceeding 2%, while Germany's Dax40 index continues to rise with a 0.55% increase. Coalition talks in Germany following the Federal Elections are being closely monitored, along with developments regarding defense spending.

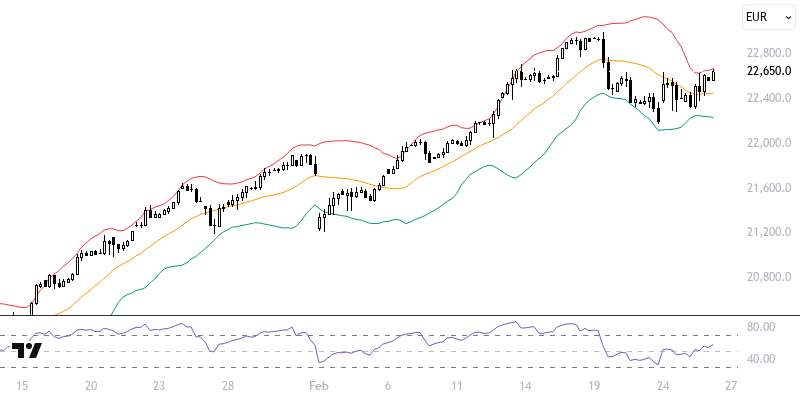

The technical analysis of the Dax40 index indicates that it has remained below the 21 and 55-period moving averages in the reactive process that began from the 23000 peak. These averages provide critical support for the index to maintain its optimism. If prices remain above the 22215 – 22535 range, the likelihood of reaching the 23000 peak again increases. The 22680 barrier could answer whether it is a reaction sell-off or a trend rally. In the event of a potential decline, staying below 22215 should be watched carefully.

Support :

Resistance :