DAXEUR

European stock indices continue to attract attention with their performance since the beginning of the year. In a market displaying a mixed outlook this week, it is significant that Europe (excluding France) maintains its optimism. While the EMEA region has experienced significant declines, and Asia is under pressure with the U.S. accelerating its realization process, the Netherlands stands out with a performance exceeding 2%. Germany's DAX40 index continues to move with a positive outlook of 0.55%. Developments focused on the U.S., particularly related to coalition talks and defense spending, along with the financial results of AI leader NVIDIA, may influence the direction of global stock indices.

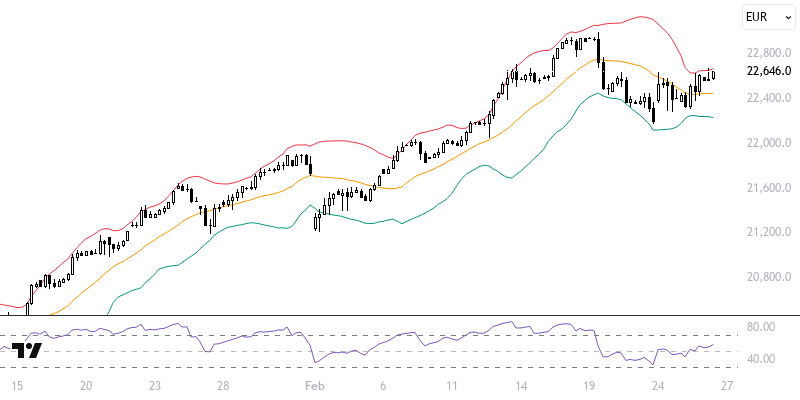

Looking at the technical analysis of the DAX40 index, the reactive process that started from the 23000 peak did not stabilize below the 21 and 55-period averages. These averages provide critical support for the index to maintain its optimism. As long as it remains above the 22215 – 22535 range, reaching the 23000 peak again seems possible. The 22680 barrier raises the question of whether there will be a reactive sell-off or a trend rally, while potential stability below 22215 should be considered for trend change implications. In this case, a new pressure towards the 21910 – 22050 range may be observed. Key levels for the day are 22215 and 22680.

Support :

Resistance :